Japan Markets ViewProposal for Growth Companies to Utilize Shareholder Benefits to Engage with Individual Investors

Sep 22, 2025

[Keiichi Nakayama, QUICK Market Eyes] “In a market driven by individual investors, shouldn’t companies be strategically utilizing shareholder benefit programs?” On September 10, The UTokyo Center for Applied Capital Markets Research (UTCMR), which advocates for the revitalization of the capital markets, published a flash report. The report proposes that growth companies, among others, should utilize shareholder benefits—a system often considered unique to Japan—as a means of building connections with individual investors. Some companies listed on the Growth Market have already introduced these benefits, and future developments are drawing attention.

Shareholder benefit programs are a unique feature of the Japanese market, implemented by many companies. These programs often involve gifting shareholders items such as vouchers for the company’s own products and services, with the aim of increasing the number of individual investors and encouraging long-term share ownership. In recent years, many companies had abolished these programs to adhere to the principle of shareholder equality and ensure fair profit distribution. However, the number of companies introducing or newly establishing them has recently been on the rise. UTCMR compiled this flash report as a preliminary bulletin, distinct from the policy proposal reports it has published in the past.

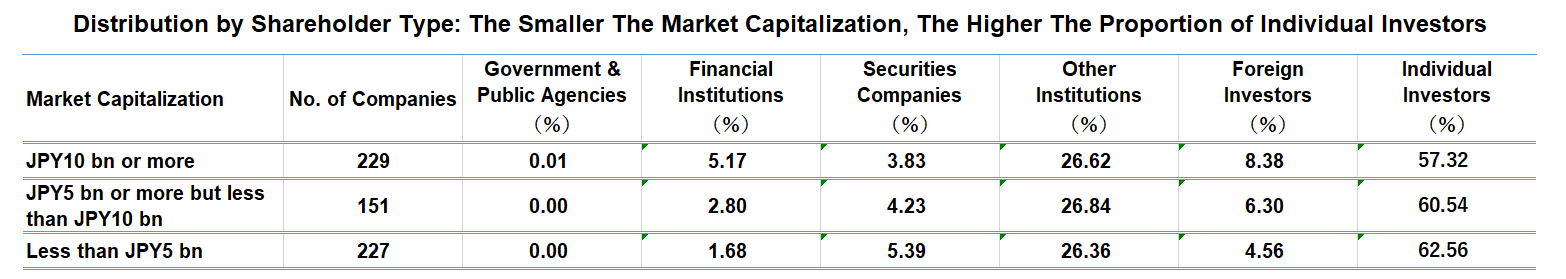

Maiko Ohno, the UTCMR fellow and Representative Director of MCG Partners Inc. who compiled the report, points out, “Many companies listed on the Growth Market do not meet the investment criteria for institutional investors due to their scale, such as the ratio of tradable shares, and stock liquidity.” She further argues that since smaller companies currently have a high proportion of individual investors, “it would be effective to ‘strategically’ utilize shareholder benefits in line with a company’s stage of growth.”

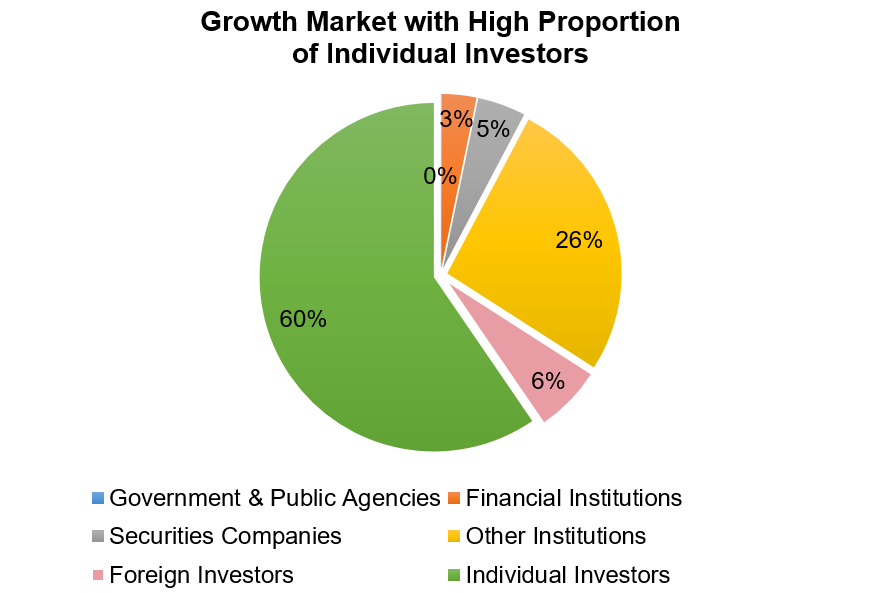

Individual investors currently make up a large portion of the shareholders in companies listed on the Growth Market. There is a notable trend where the smaller the market capitalization, the higher the ratio of individual investors.

*Source: Created from QUICK Workstation (AstraManager) for companies listed on the Growth Market as of the end of August.

Ms. Ohno lists several advantages of shareholder benefits: (1) They can be introduced even by unprofitable companies, creating a point of contact with shareholders that differs from dividends. (2) Depending on the type of benefit, they offer the flexibility of being treated as selling, general and administrative (SG&A) expenses, making them tax-deductible. (3) There is room for substantial cost control through non-progressive designs. (4) They can serve as a substitute for investor relations (IR) by promoting the brand and fostering a psychological sense of belonging. For companies, she believes these programs can improve the supply and demand dynamics of their stock and help maintain connections with shareholders, especially during temporary business downturns.

“It is important for companies to change how they utilize shareholder benefits according to their stage of growth,” says Ms. Ohno. She suggests that for smaller companies, this is a period for building connections with shareholders. For companies with a tradable market capitalization of around JPY10 bn to JPY50 bn, a more flexible approach is required. This includes introducing incentives for long-term shareholders, designing a total return that balances benefits with dividends, and ensuring alignment with financial soundness. For even larger companies, she believes it is more effective to shift the focus of shareholder returns from benefits to dividends and share buybacks.

Atsushi Kamio, a Senior Researcher at the Daiwa Institute of Research Ltd., states, “While companies aiming for growth on the Growth Market should be investing solidly to fuel that growth, introducing shareholder benefits after carefully assessing the timing and allocation of management resources could lead to the formation of a new shareholder base.” He generally agrees with the proposals in the report.

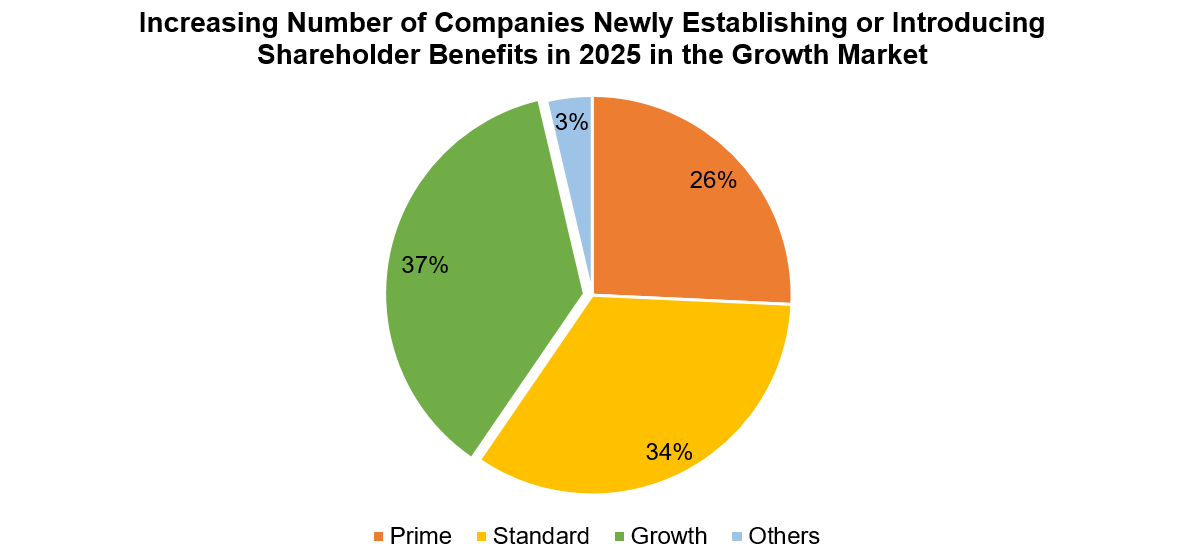

The introduction of shareholder benefits is already on the rise among companies listed on the Growth Market. A mechanical search of timely disclosure documents up to September 11, 2025, using keywords such as “new establishment of shareholder benefits” or “introduction of shareholder benefits” yielded over 130 results for 2025, with 37% of them being from Growth Market companies.

*Extracted from timely disclosure information using the search terms “new establishment of shareholder benefits” and “introduction of shareholder benefits.”

The listing maintenance standards for the Growth Market are scheduled to be revised from the current “market capitalization of JPY4 bn or more after 10 years of listing” to “market capitalization of JPY10 bn or more after 5 years of listing.” Even now, many listed companies lack a connection with individual investors. It appears that individual investors will need to invest in companies that offer shareholder benefits while carefully assessing the feasibility and sustainability of those programs.

(Reported on September 16)

Related dataset

Update on Shareholder Benefits:

https://corporate.quick.co.jp/data-factory/en/product/data019/

Related article

Two Conflict Views on Right to Shareholder Proposal – Could Debate Advance Corporate Governance in Japan?

Disclaimer

https://corporate.quick.co.jp/en/terms/#disclaimer