Japan Markets ViewNippon Gas Selected as a “DX Grand Prix 2022”; What was Evaluated?

Jun 24, 2022

The Ministry of Economy, Trade and Industry (METI) and the Tokyo Stock Exchange (TSE) jointly announced on June 7 the 33 companies selected as “DX (Digital Transformation) Stocks 2022” and 15 companies selected as “Noteworthy DX Companies 2022.” Two companies, Chugai Pharmaceutical (4519) and Nippon Gas (8174), were selected as “DX Grand Prix 2022” companies that have made particularly outstanding efforts. METI hopes to encourage companies to promote DX by introducing attractive companies to investors who are focused on improving corporate value over the medium to long term. Such selection has been made annually since 2015, and this is the eighth time. Until 2019, it was announced under the name of “Competitive IT Strategy Company Stocks,” but in 2020 it was renamed “DX Stocks.” Nippon Gas had been a regular company selected as a DX stock for six consecutive years until 2021, but winning the Grand Prix may draw even more attention.

The “DX Stocks” selected by METI are companies listed on the Tokyo Stock Exchange that have established internal mechanisms to promote DX that lead to increased corporate value, and have demonstrated outstanding achievements in the use of digital technology. The DX stocks are introduced by selecting up to one or two companies from each industry. These companies were selected not only for their introduction of superior information systems and utilization of data, but also for their ongoing efforts to reform their business models and management based on digital technology. The companies are expected to make the most of digital technology in their business operation.

Nippon Gas is a major gas company operating in the Kanto region and has specialized in energy retailing responsible for the last mile. However, recent advances in innovative technology, carbon neutrality, and the increase and intensification of natural disasters have led to a major shift toward flexible, locally distributed systems that can provide a self-sustaining supply even in times of disaster.

The company has abandoned the concept of gas and electricity retailing and set its sights on evolving into an energy solutions business, NICIGAS 3.0. Specifically, the company will not only deliver gas and electricity as a set to customers, but also provide solar power generation, electric vehicles (EVs), storage cells, and other equipment to make them into smart homes. It will further develop Metaverse virtual space technology which it has realized via LP gas wheeling service. It will also propose optimal energy use to a wide range of local communities. Through such initiatives, the company aims to further enhance its corporate value. The judges who selected the company as a DX Grand Prix 2022 said, “The company’s positioning of DX in its management strategy is clear and convincing. While the company is a regular DX stock, the fact that it shows steady evolution every year is excellent, and its ability to realize its goals is also sufficient.”

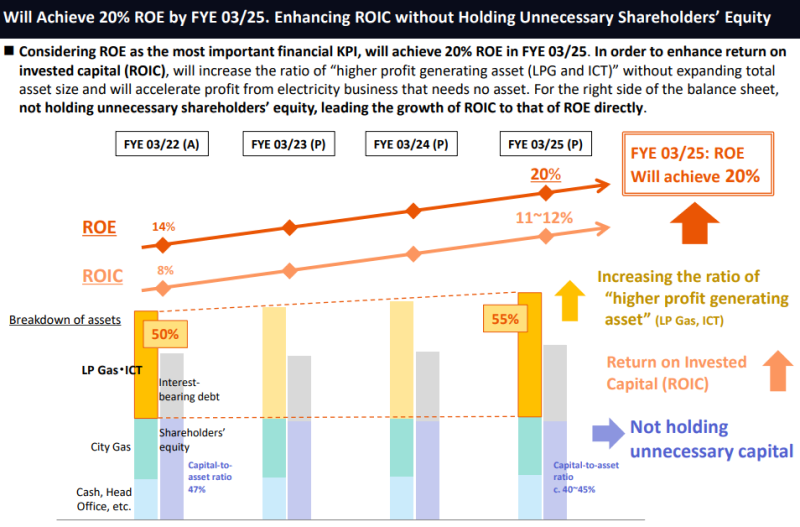

*Excerpt from “Financial Results Briefing Materials for FY Ended In March 2022” published on Nippon Gas’s website.

Nippon Gas has also set ROE (Return on Equity) as the most important KPI (Key Performance Indicator) in terms of finance, and intends to raise ROE to their target of 20% in FY3/25 (14% in FY3/22). The company has indicated that it intends to increase profitability by focusing on LP gas and ICT (Information and Communication Technology), which have high ROIC (Return on Invested Capital) ratios, without increasing its capital adequacy by increasing its total return ratio to nearly 100%. Such intention of the company is likely to attract attention. Its stock price had been stable since the beginning of 2022, and after the announcement of the full year financial results, the stock price soared and broke through the psychological milestone of 2,000 yen. The company’s stock price is likely to benefit from the fact that preference for defensive stocks is expected to strengthen due to caution over monetary tightening in the U.S., and is expected to remain stable for some time.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/