Japan Markets ViewNew TOPIX – Evaluation and Expectations for Promoting Competition

Jul 05, 2024

[QUICK Market Eyes] On June 19, JPX Market Innovation & Research (JPXI) of the Japan Exchange Group (JPX, 8697) unveiled a new plan for the Tokyo Stock Price Index (TOPIX) revisions. While maintaining the index’s consistency, the new framework will narrow the number of constituent stocks, include Standard and Growth Market stocks as constituents, and replace constituents on a regular basis. The market is evaluating the new TOPIX, which will encourage competition among listed companies, expecting it will ultimately help improve the attractiveness of the Japanese market.

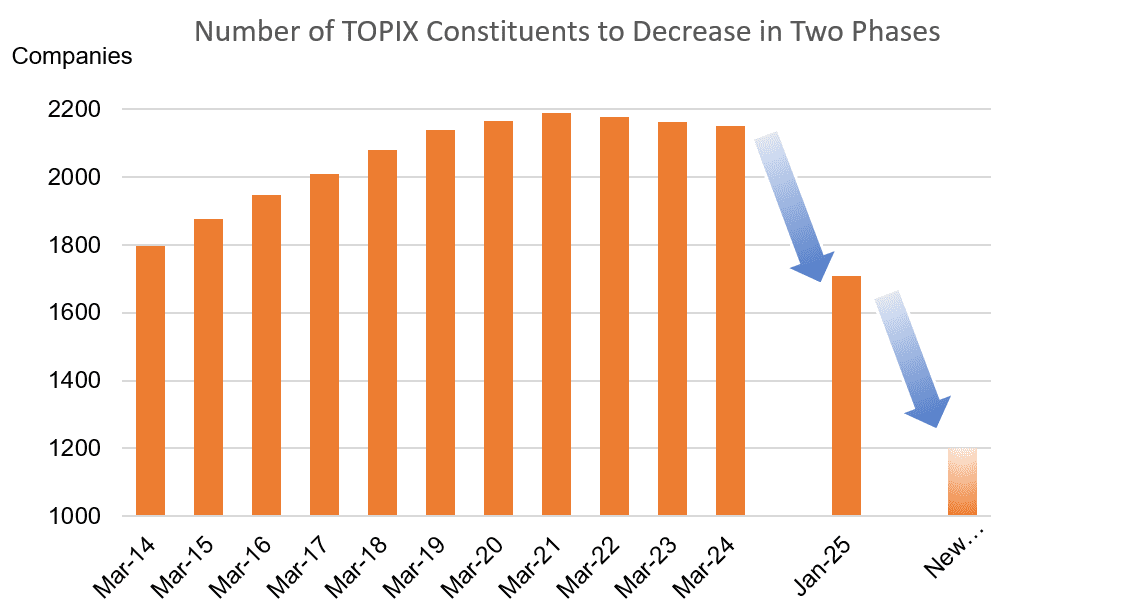

TOPIX used to be an index for the First Section stocks of the Tokyo Stock Exchange (TSE), but is currently in the first stage of revisions. Following the TSE’s market restructuring in April 2022, the index is no longer bound by market section. Stocks with a tradable share market capitalization of less than JPY10 bn are gradually excluded from the index. The number of constituent stocks will decrease to around 1,700 by the end of January 2025. This time, JPXI presented the plan for the second stage of TOPIX’s revisions, estimating that the constituents will decrease to about 1200 stocks.

*Compiled based on QUICK data and JPXI materials.

Adoption from Growth and Standard Markets, and Moves Already Occurring in Companies with High Market Capitalization

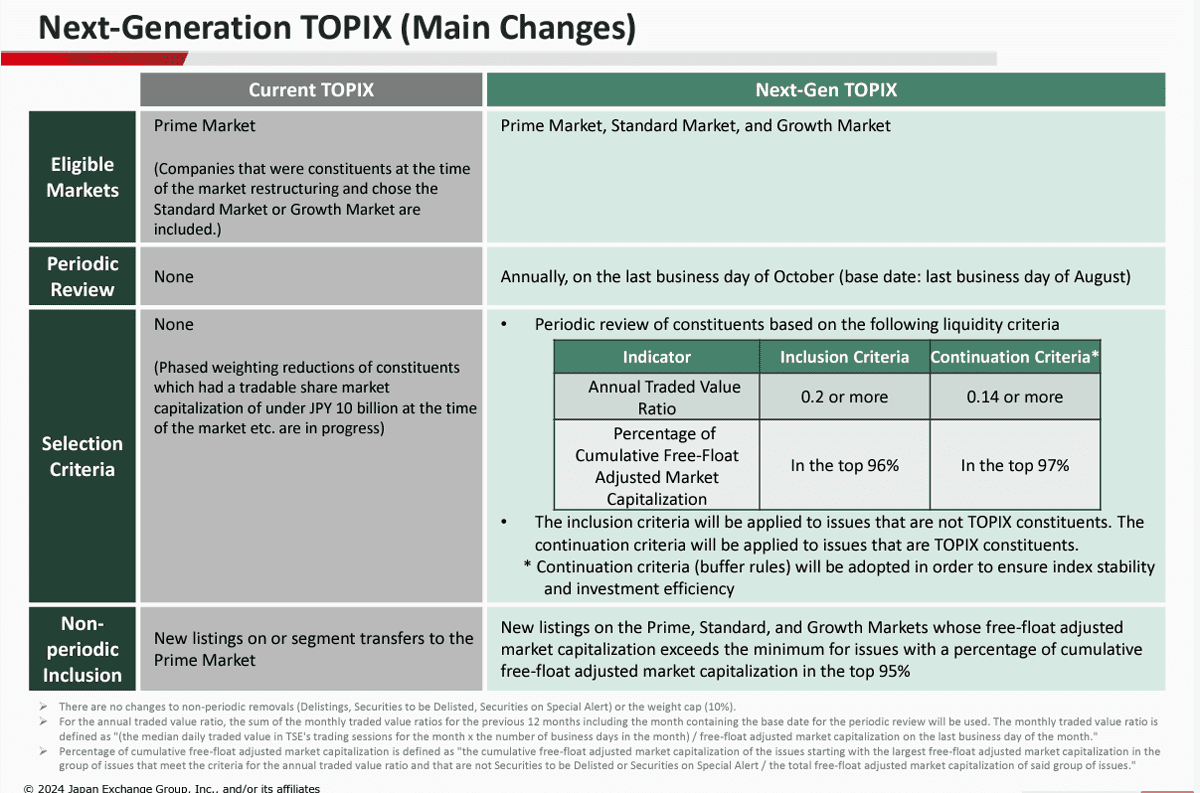

The first major change is the expansion of the range of markets covered by the constituents. Currently, the TOPIX basically consists of Prime Market stocks, but it will also include Standard and Growth Market stocks. Atsushi Kamio, Senior Researcher at Daiwa Institute of Research, pointed out, “This could be an opportunity for stocks with growth potential to remain in the Growth Market, a positive development for this market, which has seen sluggish capital inflows recently.”

Source: JPXI, Overview of Revisions of TOPIX and Other Indices

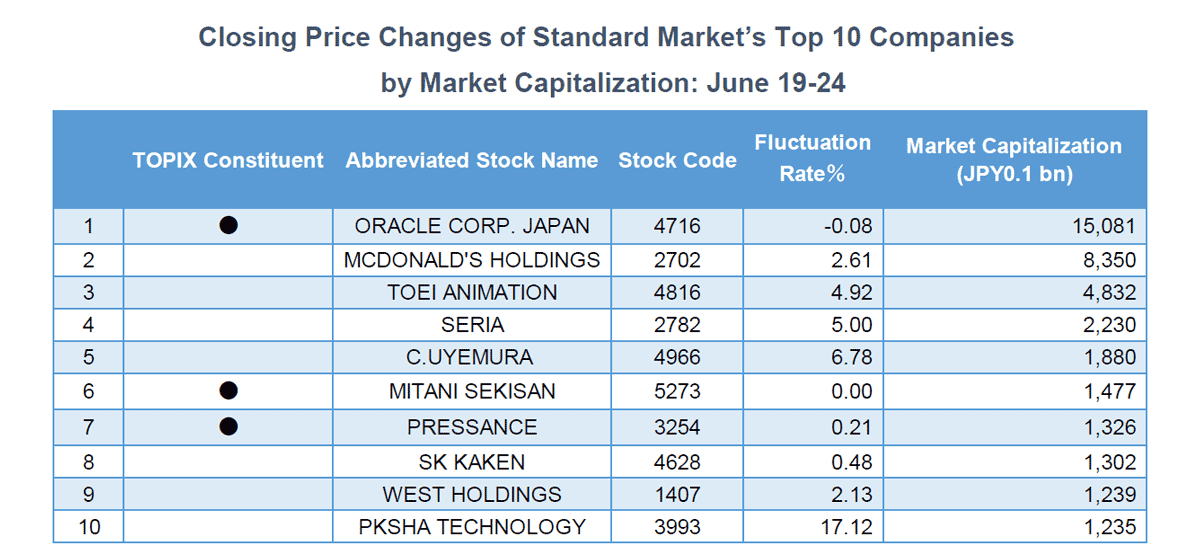

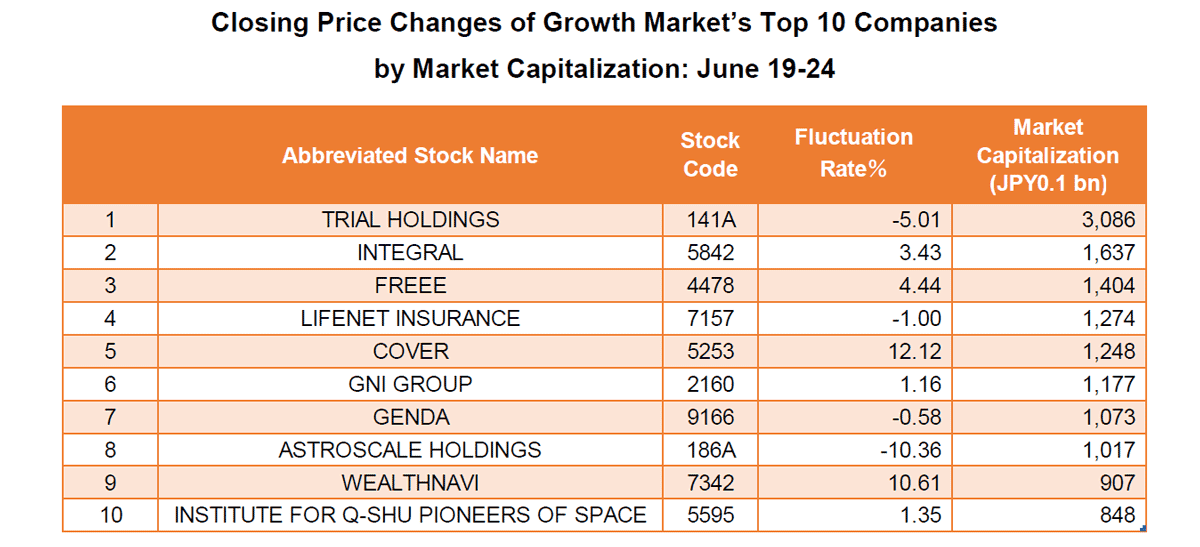

While the Growth Market has seen an increase in the number of listed companies through initial public offerings (IPOs), companies that have grown to a certain degree have tended to move to the Prime Market. Amid the concern over the declining capital inflow into the Growth Market, which nurtures prospective growth companies, it is possible for companies to choose to stay in this market and grow. Since June 20, the day after the announcement of the new TOPIX proposal, companies with the highest market capitalization in the Standard and Growth Markets have tended to see a rapid inflow of investment funds.

*Compiled based on the QUICK data.

*Compiled based on the QUICK data.

Transformation from Lackluster Mechanism

The second major change proposed in the TOPIX revision plan is to periodically change the number of constituent stocks based on two criteria: liquidity and market capitalization. For liquidity, “annual traded value ratio” will be used as an absolute criterion to select the constituent stocks from among all the target stocks. It is calculated by dividing annual traded value by free-float adjusted market capitalization. The annual traded value ratio of 0.2 or more will be a criterion for selecting new constituents. For market capitalization, selection is made using a relative criteria of “percentage of cumulative free-float adjusted market capitalization.” This is calculated by accumulating the free-float adjusted market capitalization in descending order from among the group of stocks selected based on the “annual traded value ratio.” The top 96% of stocks will be a criterion for selecting new constituents.

Since “percentage of cumulative free-float adjusted market capitalization” is a relative criterion, the final number of constituent stocks selected based on this criterion may vary. For example, if the market capitalization of large-cap stocks becomes relatively large, their proportion of free-float adjusted market capitalization will increase. As a result, the number of stocks adopted as constituents will decrease. The JPXI’s data estimates that the number of constituent stocks will decrease to 1,200, but some market participants estimate that the number will be around 1,000.

Keiichi Ito, chief quant analyst at SMBC Nikko Securities, pointed out, “Until now, once a stock was selected as a TOPIX constituent, there was no pressure to be excluded from the index, reducing vitality in the stock market. The proposed revisions to the new TOPIX, which will replace constituents on a regular basis, will provide companies with carrot and stick. Increased pressure from the competitive environment is expected to have a positive effect. The reduction in the number of constituent stocks will also help simplify the procedures for exercising voting rights, which may positively impact the governance of Japanese firms.

Nozomi Moriya, strategist at UBS Securities, also has high expectations for the new TOPIX, saying, “It is a mechanism to enhance the quality of the market as a whole.” Though each company must make efforts to improve its corporate value, she noted that the proposed revisions would encourage companies to increase their value in order to continue to be a constituent of TOPIX, Japan’s leading index.

The JPX will also be required to provide detailed explanations to companies that may be excluded from the TOPIX constituents. On the other hand, a market participant said, “Some companies with low market capitalization are already exploring measures they can take and implement to stay in the TOPIX.” It is hoped that changes in many companies will enhance the vitality and reputation of the Japanese market as a whole.

(Reported on June 26)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/