Japan Markets ViewNew Form of TOPIX to Be Unveiled in Mid-Year

May 23, 2024

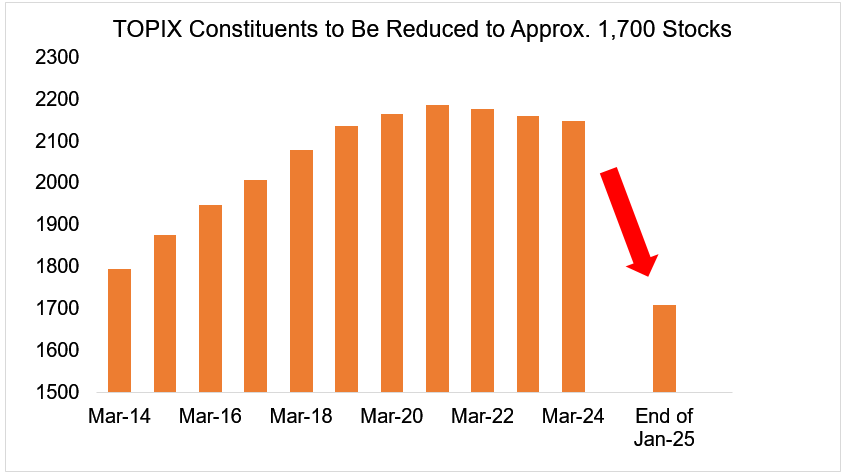

[QUICK Market Eyes] The number of constituents of the Tokyo Stock Price Index (TOPIX), which represents a broad range of Japanese stocks, will decrease by approximately 20% by the end of January 2025. The framework for the subsequent TOPIX is to be announced in mid-2024. The index may take a new form, for example, by setting a cap on the number of constituent stocks.

TOPIX is a leading index along with the Nikkei 225. Previously, all stocks listed on the First Section of the Tokyo Stock Exchange (TSE) were TOPIX constituents. However, with the TSE’s market restructuring in April 2022, the index was separated from the market section, and specific criteria were established for its constituent stocks. Stocks with a tradable share market capitalization of less than JPY10 bn, which is calculated based on the number of shares circulating on the market, are designated as “phased weighting reduction constituents.” These stocks will be excluded from TOPIX by the end of January 2025 through inclusion ratio reduction in stages.

On October 6, 2023, JPX Market Innovation & Research of Japan Exchange Group (JPX, 8697) announced that 439 stocks would eventually be excluded from the TOPIX. The number of constituent stocks will decrease from 2,148 as of May 15, 2024, to around 1,700 by the end of January 2025.

*Compiled based on the QUICK data.

■ Gust of Wind for Phased Weighting Reduction Constituents but No Wind for TOPIX

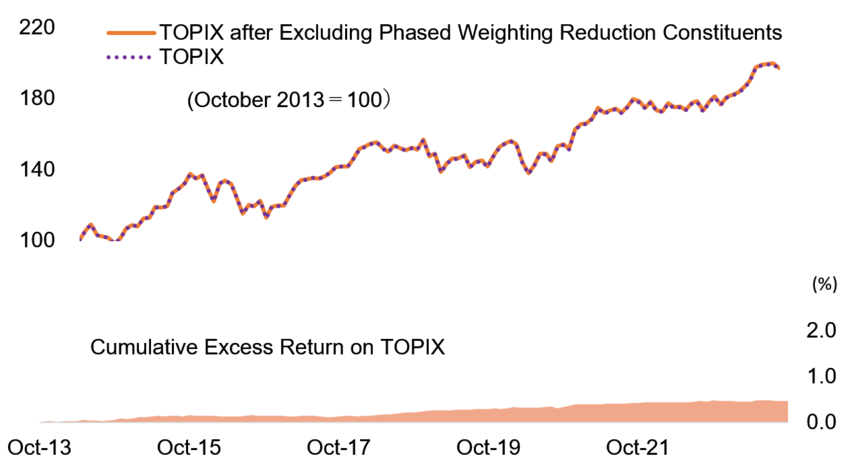

To what extent would TOPIX be affected by the exclusion of approximately 20% of its constituents? Chizuru Morishita, a researcher at NLI Research Institute, explained, “It is a gust of wind for the phased weighting reduction constituents, but almost no wind for TOPIX.

Ms. Morishita estimated the performance of TOPIX after the revision, which excludes “phased weighting reduction constituents,” and the performance of TOPIX when a re-evaluation of “phased weighting reduction constituents” had not been made for the period from November 2013 to October 2023. The result was a slight difference of +0.473% for TOPIX after the revision. TOPIX is calculated using the weighted average method of market capitalization. Therefore, excluding a bundle of companies with low market capitalization would not have a significant impact on the index.

* Compiled by NLI Research Institute

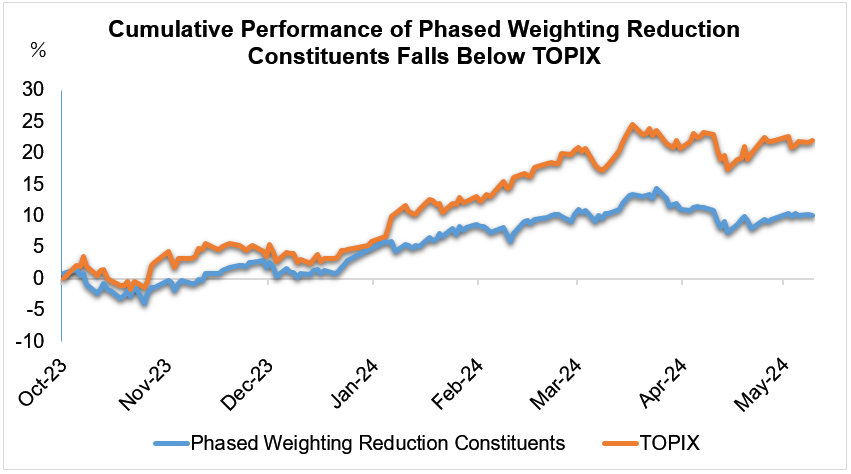

On the other hand, a significant difference emerged when comparing the performance of the “phased weighting reduction constituents” and the current TOPIX after October 2023, when the 439 issues to be excluded were finalized. Taking October 2023 as the base of 100, TOPIX achieved a return of over 21% by May 13, while the “phased weighting reduction constituents” group had a return of about 10%, resulting in a large difference.

*Compiled using the QUICK terminal’s “Back test” function.

■ JPX CEO Yamaji Plans Renewed TOPIX “to Be Completed and Seek Opinions by Mid-Year”

JPX is also considering a framework for TOPIX. At the regular press conference on April 30, JPX CEO Hiromi Yamaji commented on the direction of TOPIX after February 2025, saying, “At this point, we do not have a blueprint for the framework, but we will finalize it probably by the middle of this year and seek opinions from market participants.”

Two main changes are expected in TOPIX. The first is to cap the number of constituents, and the second is to add newly listed stocks from markets other than the Prime Market, such as the Standard Market and the Growth Market, to the constituent stocks.

Some market participants are hoping for a change in TOPIX through a drastic reduction of constituent stocks in order to enhance its functionality. Meanwhile, other market participants point out that “a significant reduction in the number of constituent stocks is not realistic considering the cost of passive funds.” JPX CEO Yamaji also said at the press conference, “Given the large number of TOPIX users, we have to give due consideration to the impact of a drastic change.”

Ken Iizuka, General Manager of the General Affairs, Planning & Development Group, Index Business Department, JPX Market Innovation & Research, explained to QUICK, “Currently, no rules have been decided on the renewed TOPIX. On the other hand, to ensure that TOPIX can be used without inconvenience after February 2025, we will decide on new rules by the end of 2024 and solicit opinions from the market.” According to Mr. Iizuka, about two months will be set aside for soliciting opinions to “respond with careful communication with market participants.”

Atsushi Kamio, Senior Researcher at Daiwa Institute of Research, pointed out, “The maximum number of TOPIX constituents should be narrowed down to about 1,000 to 1,500 stocks to create a sense of competition among companies and revitalize the market as a whole.” At present, the renewed TOPIX framework is shrouded in a veil. The “mid-year,” when the details will be revealed, is close at hand. It is likely to be the focus of market attention.

(Reported on May 17)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/