Japan Markets ViewJPX Prime 150 Index Quietly Outperforming Nikkei 225 and TOPIX

Sep 06, 2024

The JPX Prime 150 Index, launched by Japan Exchange Group (JPX, 8697) in July 2023, has been quietly outperforming the Nikkei 225 and the Tokyo Stock Price Index (TOPIX). Despite its lower profile, the index, composed of “value-creating” companies with earning power, has the potential to enhance growth and quality reputation over the medium to long term.

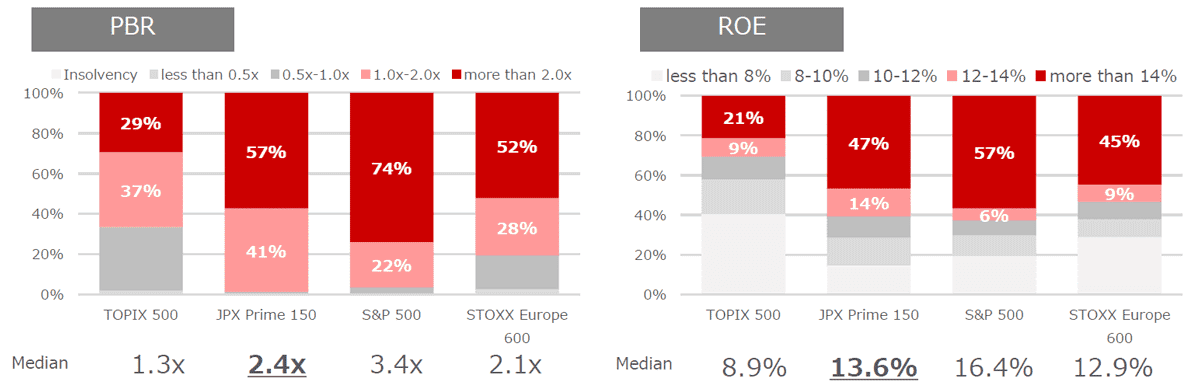

JPX Market Innovation & Research (JPXI) selects the JPX Prime 150 Index constituents from the top 500 Prime Market listed stocks by market capitalization based on the two criteria: (1) “equity spread (ES),” which is return on equity (ROE) minus cost of capital, and (2) high price-to-book ratio (P/B ratio). The index consists of 150 stocks, with 75 stocks selected for each criterion. Compared to the TOPIX, the ROE and P/B ratios of the constituent stocks are high, and are not inferior to those of European and U.S. indices.

*Source: JPXI, Status of Constituent Stocks

https://www.jpx.co.jp/english/news/6030/dh3otn000000cs6e-att/e_prime150data.pdf

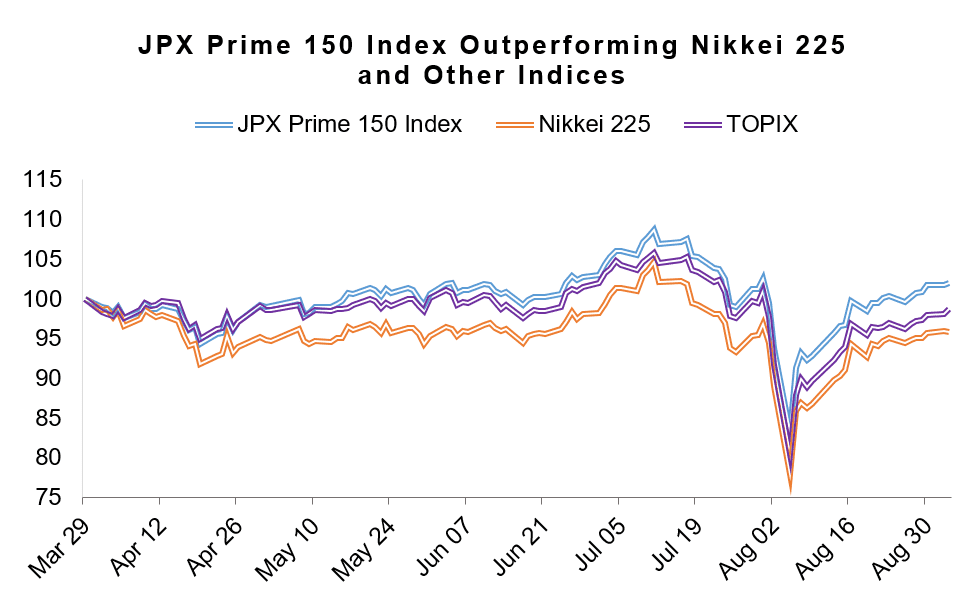

The index got off to a sluggish start. However, since March 2024, it has been outperforming the Nikkei 225, Japan’s leading stock price index, and TOPIX, stock price index representing the overall market. Even after the major market correction phase in August, the index has recovered faster than other indices.

*Relative comparison with the end of March as 100

The JPX Prime 150 Index tends to underperform the TOPIX when value stocks are highly appreciated, such as during a global interest rate hike. On the other hand, since the index comprises large company stocks with a focus on growth potential, it tends to outperform the TOPIX when growth stocks are predominant. With expectations of interest rate cuts in the U.S. and Europe growing stronger, “funds may be directed toward growth stocks taking into account the past selective buying patterns,” according to a strategist.

Toyota, Mitsubishi Corporation, etc. Selected through First Replacement; Low Profile Being a Challenge

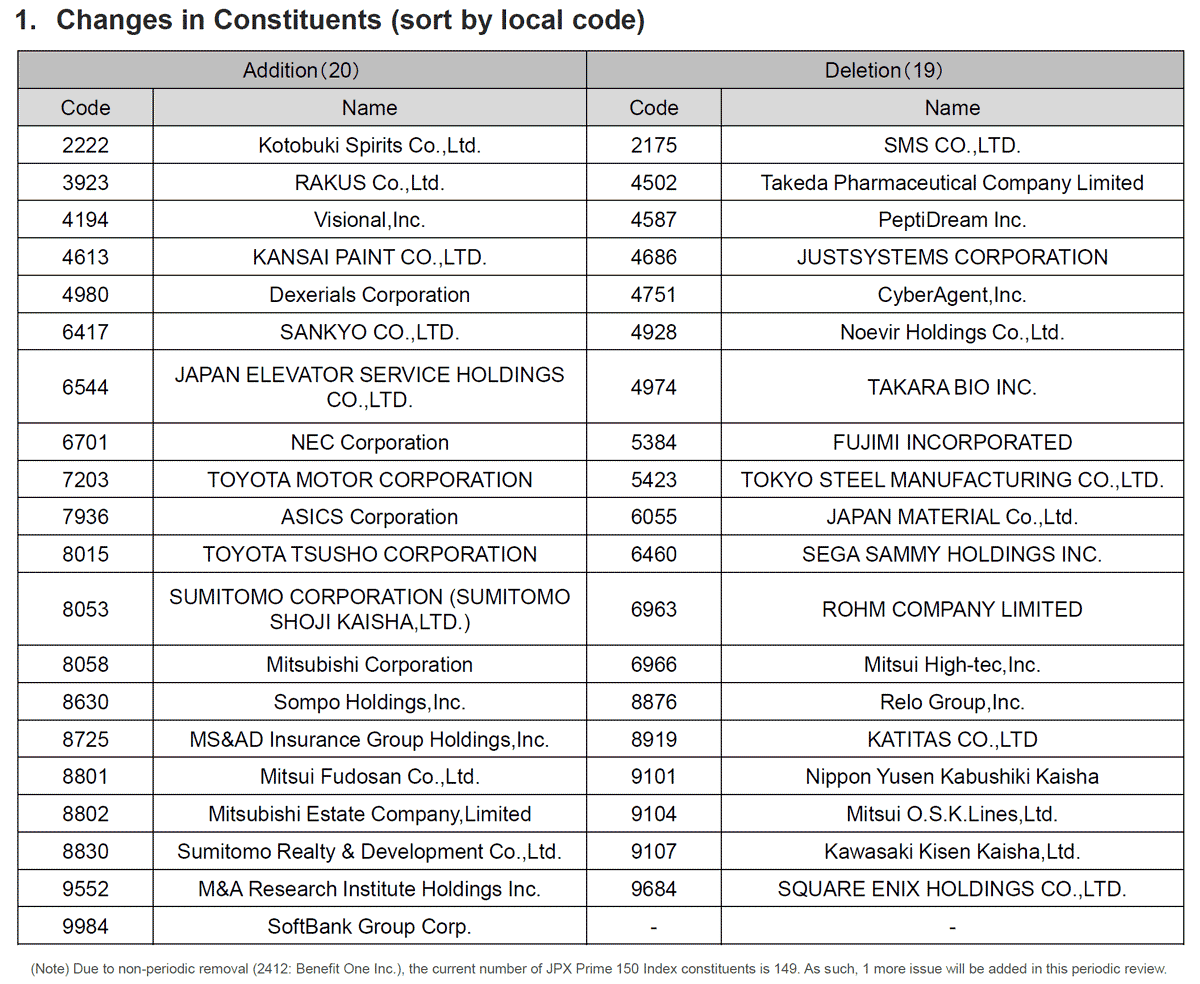

On August 30, JPXI conducted the first periodic replacement of the JPX Prime 150 Index constituents. As a result, 19 stocks, including Mitsui O.S.K. Lines (9104) and Nippon Yusen (9101), were excluded from the index, while 20 stocks, such as Toyota Motor (7203) and Mitsubishi Corporation (8058), were added to the index.

*Source: Results of the Periodic Replacement of the JPX PRIME 150 Index and the List of Constituent Stocks

https://www.jpx.co.jp/english/news/6030/dh3otn000000cs6e-att/e_prime150.pdf

The JPX Prime 150 Index’s market coverage rose from 50% before the periodic replacement to 58% with the inclusion of large-cap stocks. JPXI expects the index to outperform the TOPIX in terms of growth, such as profit growth, and to keep its characteristics and performance different from the TOPIX.

One of the challenges for the JPX Prime 150 Index is a low profile in the market. Although exchange-traded funds (ETFs) and publicly offered investment trusts have been established since the beginning of 2024, the total net asset value remains at around JPY24 bn. In March, the JPX Prime 150 Index Futures was launched to provide a means of hedging, but even in the lead contract month, there are many days when trading does not take place.

On September 3, QUICK Corp. held a seminar on reviews and future measures for “Management Conscious of Cost of Capital and Stock Price,” which the Tokyo Stock Exchange (TSE) requested companies to implement, and on the JPX Prime 150 Index. The seminar brought together 450 participants at the venue and online.

In the Q&A session on the JPX Prime 150 Index, participants asked about the index’s media exposure and what is needed to increase the number of products linked to it. Motohiro Hashimoto, Head of JPXI’s Index Business, explained, “It is important to promote understanding of the index and enhance its profile.” As the index is different in nature from the TOPIX, which represents the market as a whole, “JPX Group will join forces to promote the JPX Prime 150 Index,” he added.

A strategist at a Japanese securities firm pointed out, “Even an index with an excellent concept needs to be exposed to a large number of people on a daily basis through TV, newspapers, etc.” It is hoped that the index’s improved performance, together with JPX Group’s careful explanation to the market, will create a virtuous cycle toward increased market recognition.

(Reported on September 5)

Related dataset

QUICK Licensed News: QUICK original news on the Japanese market

https://corporate.quick.co.jp/data-factory/en/product/data016/