Japan Markets ViewIncreasing Shareholder Proposals, Prompting Corporate Reform

May 26, 2025

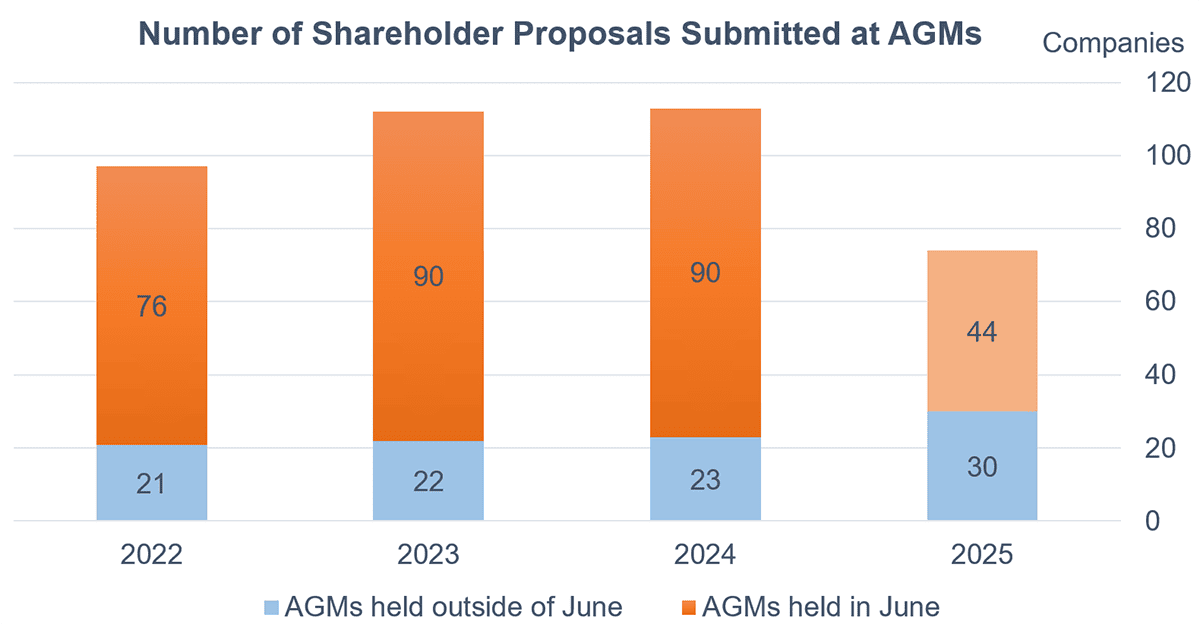

[Keiichi Nakayama, QUICK Market Eyes] Shareholder proposals in Japan are increasing ahead of the peak season for annual general meetings (AGMs) in June. The pace of shareholder proposals being identified is faster than in previous years. One point of interest is whether the number of shareholder proposals in 2025 will exceed the record high. Although many proposals are expected to be rejected at the AGMs, shareholder proposals have a potential to serve as an initial catalyst for engagement between companies and their shareholders, thereby prompting corporate reform.

As of May 9, shareholder proposals for 44 companies had been identified for the AGMs to be held in June. Hidenori Yoshikawa, chief consultant at Daiwa Institute of Research (DIR), noted, “Many shareholder proposals were submitted at the AGMs in March. On top of that, in the case of 2025, the pace at which shareholder proposals are identified for the June AGMs is faster, and the number of proposals for the year may exceed the record high.”

*Compiled by DIR

Shareholder proposals for June 2025 AGMs are counted up to those identified as of May 9.

AGMs held outside of June = Those held between July and May of the previous year

In an unusual case, Japan Airlines (JAL, 9201) submitted a shareholder proposal on April 25 to AGP (9377), which supplies electricity, etc., to parked aircraft, to take the company private. Japan Airport Terminal (9706) and ANA Holdings (9202), both of which have stakes in AGP, have endorsed JAL’s shareholder proposal.

Oasis Management, a Hong Kong-based investment fund known as an activist investor, demanded that Taiyo Holdings (4626) dismiss its President Eiji Sato and Director Kiyofumi Takano. In addition, on May 7, Asset Value Investors (AVI), a British investment fund, announced that it had made a shareholder proposal to Wacom (6727), a major pen tablet maker, demanding the appointment of Nao Makino of Kaname Capital, a US asset management firm, as an additional outside director, along with Wacom’s share buyback. The diversity of shareholders who are voicing their demands is increasing.

Mr. Yoshikawa of DIR pointed out, “Although many shareholder proposals are likely to be rejected at the AGMs in June as a result, dialogue triggered by shareholder proposals is spreading.” In some cases, shareholder proposals that were once rejected were submitted as company proposals the following year, resulting in shareholder proposals becoming a catalyst for corporate reform. Therefore, Mr. Yoshikawa hopes, “If the trend of good shareholder proposals changing companies continues, it will help enhance the corporate value of Japanese companies as a whole.”

One analyst of a Japanese securities firm noted, “Shareholder proposals regarding parent-subsidiary listings are increasing, and one of the themes of the AGMs in June will be the state of these arrangements.” In February 2025, the TSE published a document outlining how investors view them. This may have been one of the reasons for the increased interest in shareholder proposals related to the topic.

In the past, AGMs used to be formal and brief events with little discussion, which ended with unanimous approval. In recent years, the meetings have been transforming into a forum for dialogue between companies and their shareholders. An appointment ratio of the board of directors has come under closer scrutiny. Whether the increase in the number of sound shareholder proposals will serve as a catalyst for corporate reform should continue to be a focus of attention.

(Reported on May 14)

Shareholders’ Meeting Resolution Data (EDINET)

https://corporate.quick.co.jp/data-factory/en/product/data051/

If you are looking for datasets unique to the Japanese equity market, visit QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/