Japan Markets ViewIdle Money Accumulates to Record High of Over JPY16 Tn: Individuals’ Purchasing Power Grows Amid Stock Market Rally

Sep 01, 2025

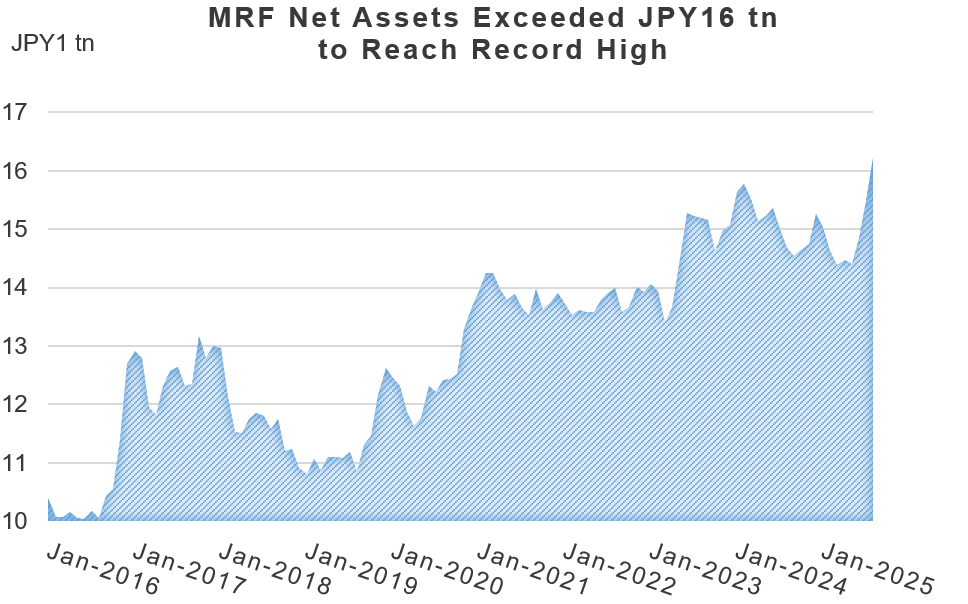

[Keiichi Nakayama, QUICK Market Eyes] The “purchasing power” of Japanese individual investors is growing. The total net assets (balance) of Money Reserve Funds (MRFs), which serve as a pool of idle money invested in highly safe assets like short-term public and corporate bonds, have recently surpassed JPY16 tn to reach a record high. From a supply and demand perspective, the current stock market rally is driven by continued corporate share buybacks and foreign investors’ active buying of Japanese stocks. Meanwhile, this idle money is waiting in the wings for an opportunity to buy on dips.

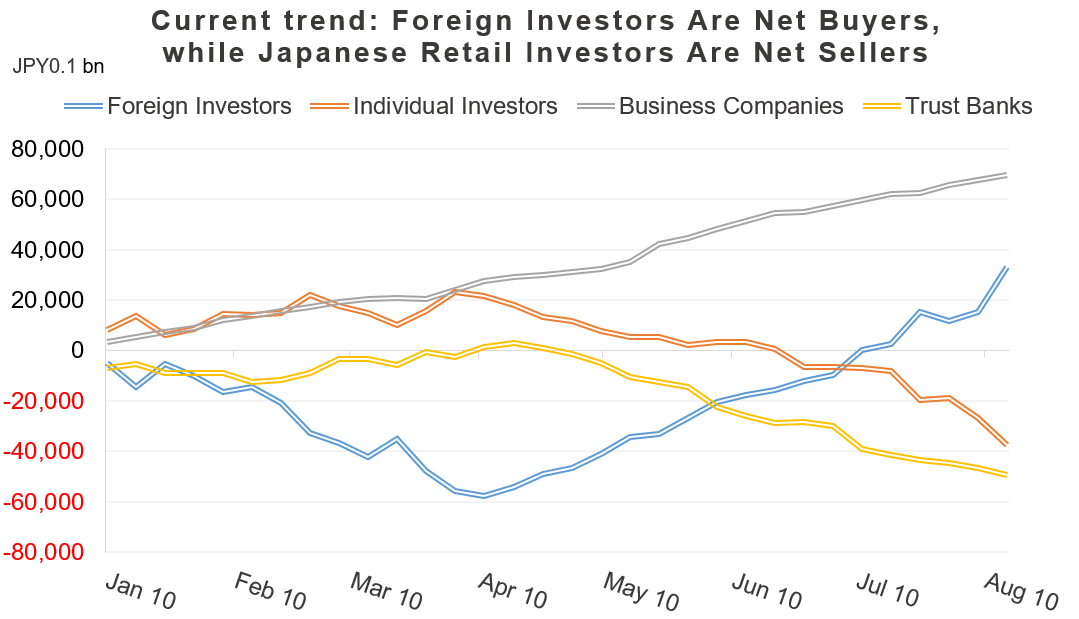

The current Japanese stock market has two major types of buyers and two major types of sellers. Business companies represent a significant buying force. Their net buying from the beginning of the year to the second week of August (August 12–15) amounted to JPY6.9624 tn. Additionally, investors outside Japan have recently been increasing their buying, primarily focused on Nikkei futures.

*Source: Compiled from data by Japan Exchange Group and QUICK

On the other hand, trust banks, which are said to mirror the trading trends of pension funds, have been net sellers, with cumulative net selling of JPY4.9595 tn since the beginning of the year. Individual investors, who tend to have a strong contrarian stance against the market trend, have also been significant net sellers, with net selling of JPY3.7467 tn year-to-date.

According to Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory, “While foreign investors appear to still have purchasing power, in the short term, stock selling due to pension fund rebalancing is likely to cap the upside of Japanese stocks.” However, Mr. Suzuki is currently focusing on the funds of individual investors who have been selling off their stocks until recently. He believes that “Individual investors are waiting in the wings for an opportunity to buy on dips, and they will become major buyers if the market level declines in the near future.”

Idle money, which indicates individuals’ purchasing power, has accumulated significantly. According to data compiled by QUICK Asset Management Research Center, the balance of MRFs reached a record high of JPY16.2156 tn as of August 22. After accumulating to JPY15.8927 tn on March 12, 2024, there was a period when the balance temporarily fell below JPY14 tn. It appears that the recent stock market rally has prompted the selling and redemption of stocks and investment trusts. As a result, funds have flowed into MRFs, which serve as a repository for this idle money.

*Source: The Investment Trusts Association, Japan. August data was compiled by QUICK Asset Management Research Center based on data released by individual companies.

Some observers point to a sense of short-term overheating in the market. Foreign investors, among others, could adopt a more defensive stance due to factors such as U.S. President Trump’s tariff policies and political uncertainty in Japan. On the other hand, with individual investors having ample purchasing power, a scenario where the market is unlikely to experience a significant decline also seems plausible.

(Reported on August 26)

Interested in the data in this article?

Contact us: https://corporate.quick.co.jp/en/contact/form_service_en/

Discover datasets unique to the Japanese equity market

Visit QUICK Data Factory: https://corporate.quick.co.jp/data-factory/en/