Japan Markets View“I will keep chasing my dream over the railroad crossing,” says the SoftBank Group CEO Mr. Son

May 20, 2021

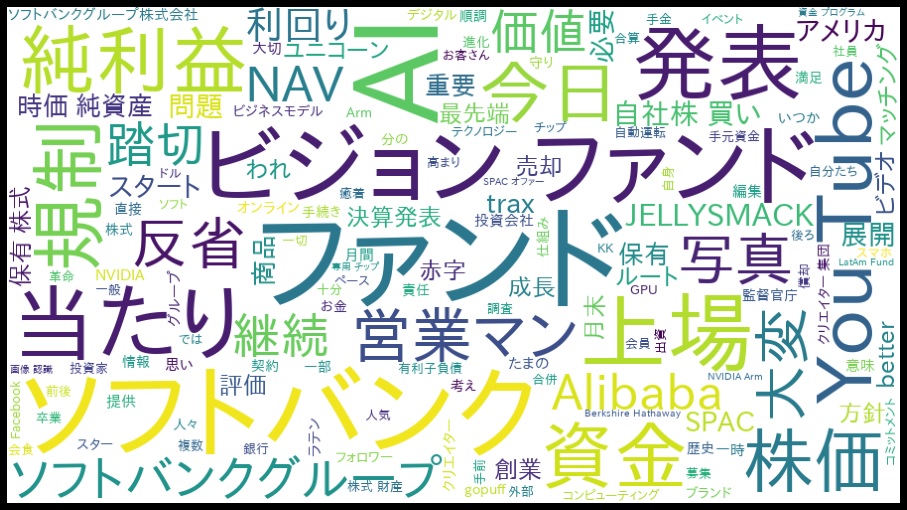

The SoftBank Group Corp. (SBG, 9984) held a briefing on May 12 for announcing the consolidated financial results (International Financial Reporting Standards) for the fiscal year ending March 2021. At the briefing, these topics were focused: ‘NAV (Net Asset Value)’, ‘JELLYSMACK’ which is AI-based creator management, and ‘Railroad crossing.’ We analyzed the transcripts provided by SCRIPTS Asia Inc. which is a partner company of QUICK Corp. with text mining.

SBG achieved the highest ever profit among Japanese companies for the fiscal year ended March 2021, a turnaround from its largest deficit whose net profit was JPY4.9879tn recorded in the previous fiscal year. Unrealized gains on investments by SoftBank Vision Fund in the South Korean e-commerce giant Coupang and the US food delivery company DoorDash have grown significantly.

SoftBank’s CEO, Masayoshi Son, pointed out there was a view that the company’s net profit of around JPY5tn in the previous fiscal year was ‘a coincidence and nothing more than a profit inflated temporarily’ thanks to globally high stock prices and the large scale IPO. On reflection, the president Son humbly accepted the failure of a few investment initiatives, but also expressed his intention of not becoming an investment company that is happy on gaining one-time profit, but how he wants to strengthening the structure of the company so that it can generate consistent profit as if it were a manufacturing company eternally producing golden eggs.

The NAV defined by the CEO Son as ‘the only measure representing SBG’s performance’ increased to JPY26.1tn, a JPY4.4tn increase from the previous fiscal year. With the buyback of stocks worth JPY2.5tn in the previous fiscal year, NAV per share was JPY15,015 at the end of the previous fiscal year, more than 60% above the recent share price.

Investment target presentation was also passionate. JELLYSMACK, funded by SoftBank Vision Fund 2, is a platform for the 21st century type of creator group to expand their earnings. The company currently has a pool of 200 popular content creators. It contracts with creators popular on platforms such as YouTube and deploys their content on other social networking sites such as Facebook and Instagram, and optimizes thumbnails and subtitles through AI. Brad Mond, a famous US stylist and YouTuber, has seen his 1 to 2 million followers surge 10 to 20 times since signing with JELLYSMACK.

‘Railroad crossing’, however, became the keyword of the briefing. At the beginning of the briefing, a photograph with a view of a city spread on the other side of ‘a railroad crossing’ was displayed. It was a photograph taken in 1981 of Zasshonokuma, a place located in Fukuoka. This was the place where Softbank Group was founded. On the other side of the crossing that the CEO Son crossed every day is bustling Zasshonokuma Station operated by Nishi-Nippon Railroad, and further is Hakata Station. But the CEO Son was thinking of Tokyo Station, a station far away from where he stood. It was that time when he vowed to cross that railroad crossing one day.

Forty years have passed since then, and even today, when SoftBank is now the largest profit making company of all the Japanese companies, the CEO Son emphasizes that SoftBank’s most important weapon and asset is the belief that the company has yet to fully cross that railroad crossing in pursuit of an even greater dream.

Analysts and the media asked questions about the company’s market capitalization. At the briefing, a question was asked about the difference in the market assessment of SBG and Berkshire Hathaway, a company led by the prominent investor Warren Buffett. The CEO Son replied that “I think that SBG has been undervalued, also believe that the company will gain a premium rating only when people evaluate that SBG can consistently generate profits and that it is not just a fluke.”

QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data005/