Japan Markets ViewGrowth Market Reform Underway: Corporate Transformation and IR Are Key

Nov 11, 2025

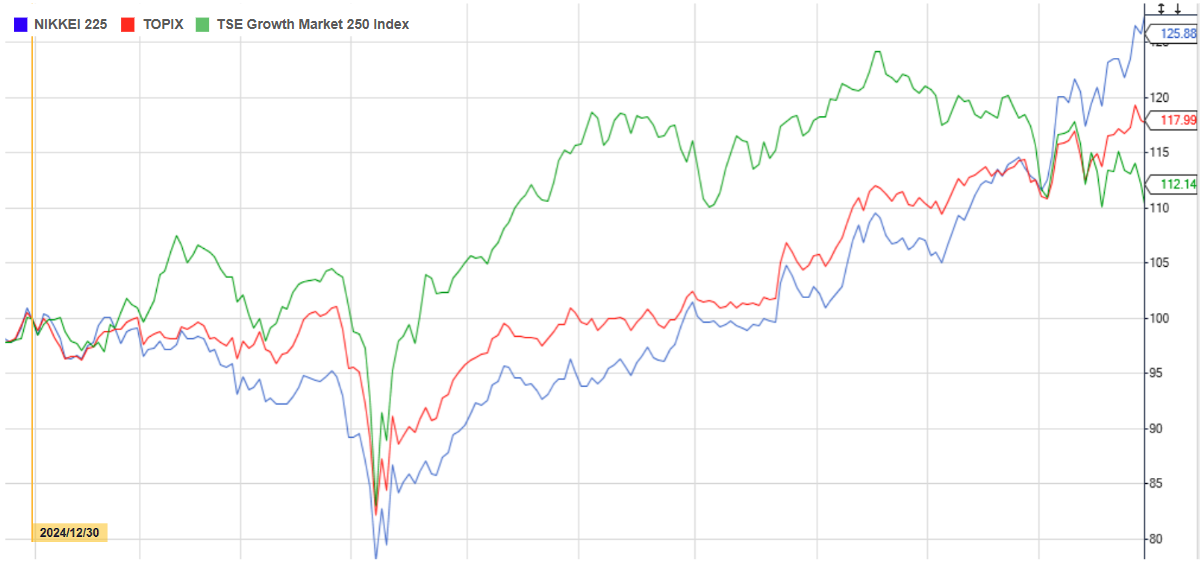

[Keiichi Nakayama, QUICK Market Eyes] After enduring a “winter” period unwelcome to stock rallies, the emerging Growth Market has begun its stride towards spring. The Tokyo Stock Exchange (TSE) Growth Market 250 Index had outperformed the Nikkei 225 and the TOPIX (Tokyo Stock Price Index) from the end of last year until the summer, but its recent performance has been lackluster. Expectations for the Growth Market reform promoted by the TSE provide support. However, it appears that the high expectations, which had swelled temporarily, have since receded. It remains to be seen whether the transformation of companies in this market, driven by the TSE’s new grassroots efforts to bridge investors and companies, will lead to a full bloom in spring.

*Charts with the end of 2024 set at 100, created by QUICK’s financial terminal.

Following lengthy discussions at the “Council of Experts Concerning the Follow-up of Market Restructuring,” the TSE has embarked on reforms for the Growth Market. In April, the TSE proposed raising the criteria for continued listing on the Growth Market. The proposal suggested changing the requirement from a market capitalization of JPY4 bn or more ten years after listing to a more stringent JPY10 bn or more five years after listing. The objective is to encourage rapid growth to a scale that attracts institutional investors. It also aims to promote M&A and encourage entrepreneurs to launch new ventures.

Meanwhile, in July, the TSE announced a proposal to establish a “grace period” for companies that fail to meet the new criteria. “This proposal would exceptionally allow companies that do not meet the criteria for continued listing to remain listed during a period specified in their plan, provided they disclose a plan to meet the criteria after 2030. This sparked concerns from some market participants, who worried that “the reform might not progress.” An official from the TSE’s Listing Department also commented, “In July, we received feedback that this could slow the momentum of the reform.”

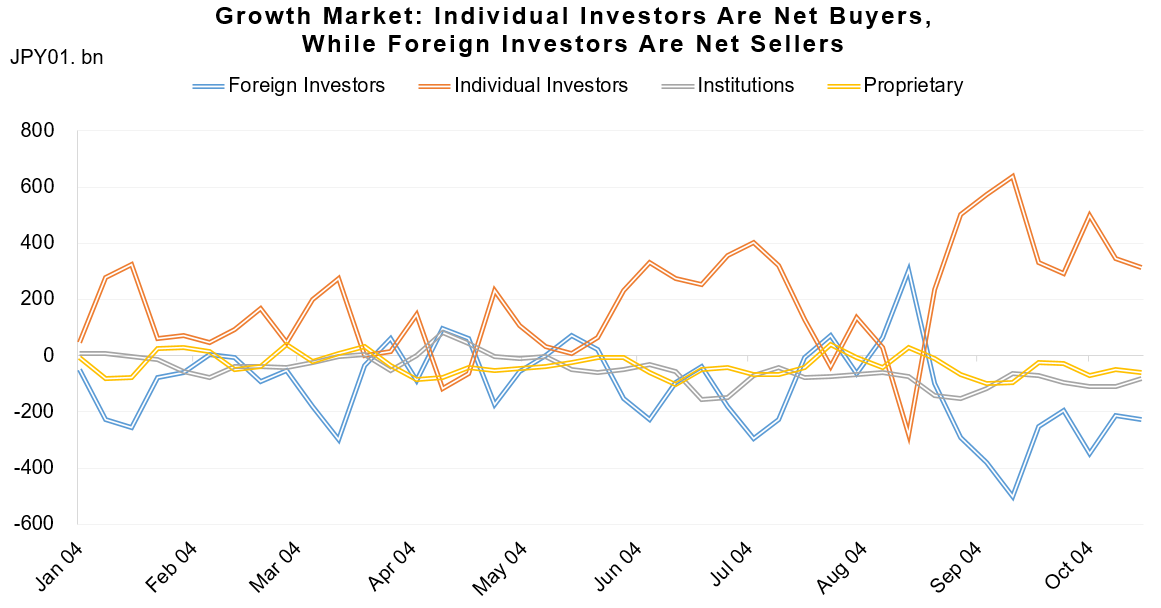

Looking at the supply and demand dynamics of the Growth Market, selling by foreign investors outside Japan has intensified since August. According to data on trading by investor type, individual investors have been net buyers on a cumulative basis since the beginning of the year. In contrast, foreign investors have been net sellers. It is not certain whether the introduction of the “grace period” triggered this. However, the selling by foreign investors has become a burden on the overall market.

*Source: TSE and QUICK data

The TSE will make a final decision on the Growth Market reforms by the end of the year, following a public comment period. Some institutional investors have expressed their “approval” in their public comments. At a press conference on October 24, Hiroaki Matsuda, Chief Financial Officer (CFO) of major venture capital firm JAFCO Group (8595), stated, “The direction of the Growth Market reform itself is extremely positive, and we value it as something that will lead to an improvement in market quality.” He also pointed out that even before the official system changes, there has been a shift in the mindset of venture company entrepreneurs regarding exit strategies.

The TSE, which is advancing market reforms, has recently begun initiatives to bridge investors and Growth Market companies. On October 7, forty seats were arranged into three groups at TSE Arrows. The TSE held a dialogue session for investor relations (IR) representatives from Growth Market companies, featuring institutional investors who actively manage funds in that market as speakers. The event reportedly reached its capacity within two hours of opening registration.

*A photo from the dialogue session between IR representatives of Growth Market companies and institutional investors at TSE Arrows.

During the dialogue session, corporate IR representatives actively questioned the institutional investors, often referencing their own company’s specific circumstances. For example, participants asked questions such as, “Our top management is reluctant to participate in IR events, but from an investor’s perspective, isn’t it better if they do?” and, “How can we catch the attention of institutional investors?” According to the TSE, there was much positive feedback from participants, such as, “We realized we share common questions, and it was a valuable opportunity to ask things we normally can’t.” The three institutional investor speakers were also surprised by the enthusiasm and uniformly expressed their view that “corporate mindsets are beginning to change.”

Atsushi Kamio, Senior Researcher at Daiwa Institute of Research, notes regarding the Growth Market, “We are focusing on corporate initiatives aimed at reaching a JPY10 bn market capitalization.” He explains, for example, that the online payment provider ROBOT PAYMENT (4374) clearly indicates its future direction, including detailed stock analysis and growth strategies. He views their activities as being conscious of the fact that the Growth Market has many individual investors. He noted their efforts include holding briefings and IR activities specifically for these investors and thoroughly reflecting the feedback they receive.

Yukihiro Hattori, Portfolio Manager specializing in small and mid-cap stocks at Invesco Asset Management (Japan), urges Growth Market companies, “We want companies to convey their message, growth story, and corporate philosophy, rather than just presenting inorganic information.” The Growth Market cannot be described as full of enthusiasm, even as it enters its “spring.” We must keep a long-term perspective on whether these corporate initiatives will ultimately change the market’s overall valuation.

(Reported on October 30)

Discover datasets unique to the Japanese equity market

Visit QUICK Data Factory: https://corporate.quick.co.jp/data-factory/en/

Related article

IR Professionals Gather at TSE to Explore Minds of Institutional Investors

Disclaimer

https://corporate.quick.co.jp/en/terms/#disclaimer