Japan Markets ViewFujikura (5803) Expands Performance Driven by Growing Data Center Demand

Nov 18, 2024

[QUICK Market Eyes] Electric wire-related stocks are attracting increasing attention. The volume of data traffic is increasing with the expanded use of cloud services. In conjunction with this, the data center market is growing in size in response to greater demand for generative AI with the emergence of interactive AI “ChatGPT.” In addition, with the strengthening of economic security and the weak yen against the U.S. dollar, a number of U.S. IT giants are building data centers in Japan. Given these circumstances, Fujikura Ltd. (5803), a major electric wire and cable manufacturer, has been attracting attention for its fiber optic cables.

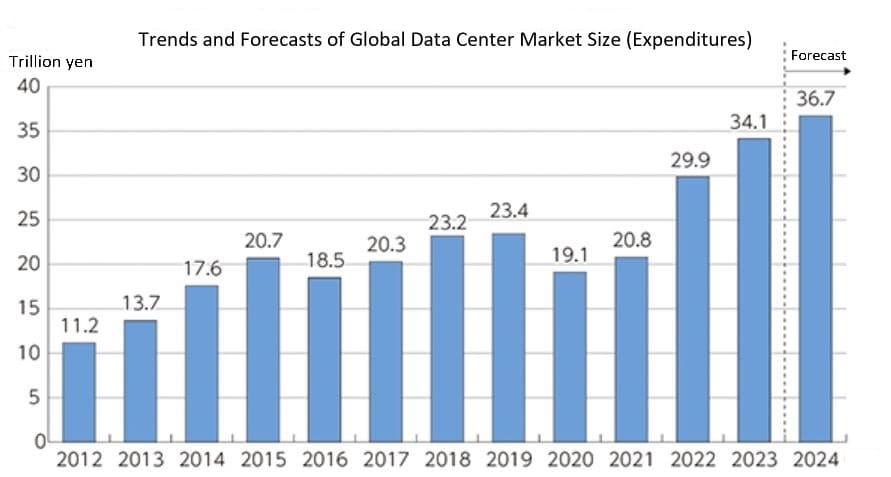

According to the Ministry of Internal Affairs and Communications’ White Paper on Information and Communications in Japan, the global data center market size began to decline in 2020. This was due to the postponement of construction work and supply chain disruptions caused by the COVID-19 pandemic. However, it has been on an increasing trend after that, and the market was forecasted to expand to JPY34.1 tn in 2023 and to JPY36.7 tn in 2024. Meanwhile in Japan, the market size was JPY2.0938 tn in 2022 and is projected to grow to JPY4.1862 tn in 2027.

Fujikura’s ultra-fine, high-density fiber optic cable, Wrapping Tube Cable (WTC), and its core technology, Spider Web Ribbon (SWR), are in the spotlight as demand for data centers increases. As the capacity of optical networks increases, cables with more cores in a limited space are becoming indispensable. WTC and SWR are designed with high bandwidth, low latency, high durability, and flexibility. These features has enabled a-high-density installation in cables. Fujikura has developed and released innovative products, especially for data centers. One example is a cable that contains 6,912 optical fibers in a diameter of 29 mm, the smallest cable in the world with this number of cores. This product has been highly evaluated for its features, such as easy and quick installation, and has been delivered to many well-known companies in Japan and overseas. Since FY 2018, sales of the product have been steadily increasing, driving the company’s earnings growth.

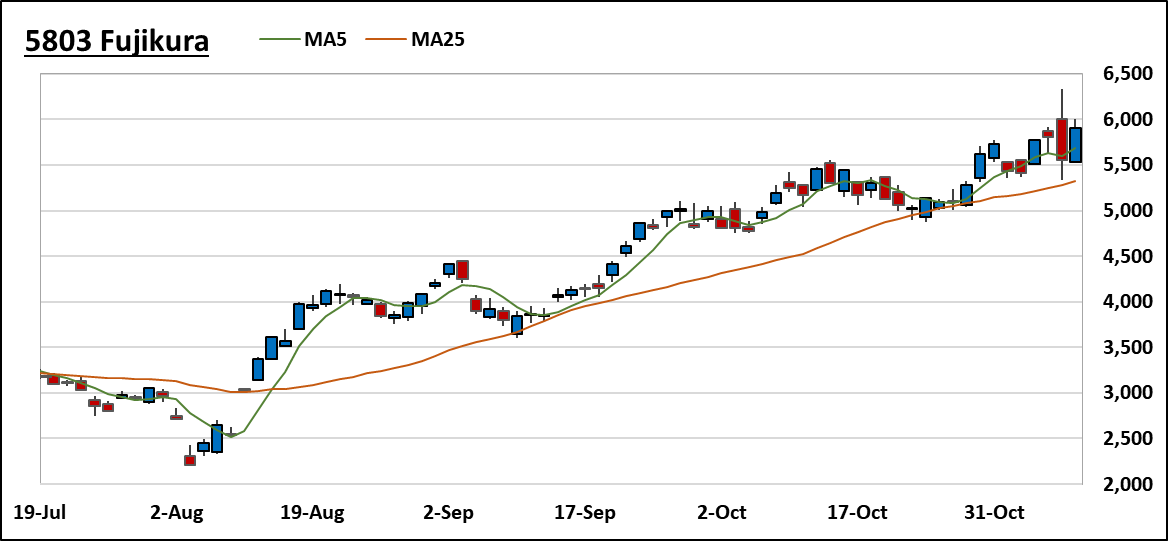

According to Fujikura’s consolidated financial results for the April-September period of 2024, announced on November 7, net sales increased 14% YoY to JPY447.5 bn, and operating income rose 79% to JPY55.1 bn, a significant increase in both sales and income. The mainstay Telecommunications Systems Business Unit benefited from increased demand for data centers amid the spread and expansion of generative AI. Fujikura has upwardly revised its forecast for the fiscal year ending March 31, 2025, in light of its recent strong performance. The company raised its projections for net sales to JPY880 bn (from JPY870 bn), up 10% YoY; operating income to JPY104 bn (from JPY89 bn), up 50% YoY; interim and year-end dividends to JPY33.5, respectively (from JPY32.5); and annual dividend to JPY67 (from JPY55 in the previous fiscal year).

The stock price is expected to rise again as the sell-off for profit-taking following the earnings announcement has run its course. In this sense, the new inclusion of the company’s stock in the Morgan Stanley Capital International (MSCI) index will be a favorable tailwind in terms of supply and demand. MSCI announced the results of its periodic review of Global Standard Indexes on November 6. Among Japanese stocks, Fujikura will be newly added as a constituent. On the other hand, following eight stocks are to be excluded: Nomura Real Estate Holdings (3231), Nippon Prologis REIT (3283), SUMCO (3436), IBIDEN (4062), ROHM (6963), Hamamatsu Photonics (6965), Mazda (7261), and Keisei Electric Railway (9009). The changes in constituents will take place as of the trading close on November 25. According to a major securities firm, demand for about 10 million shares is expected, making Fujikura an interesting stock to watch.

(Reported on November 13)

Related dataset

QUICK Licensed News: QUICK original news on the Japanese market

https://corporate.quick.co.jp/data-factory/en/product/data016/