Japan Markets ViewFocusing on MISUMI Group, a Global Supplier of FA and Die Components

Nov 01, 2021

Amidst emerging uncertainty about the manufacturing industry arising from supply chain disruptions, high resource prices, and growing logistics costs, MISUMI Group Inc. (9962) is worth watching as a company that will benefit from factory automation (FA) and next-generation manufacturing. MISUMI Group is a trading company specializing in FA and die components, and it has developed a global supply network for manufacturing sites.

MISUMI Group’s manufacturing support

To meet a variety of needs at manufacturing sites, the MISUMI Group offers more than 30 million products, including precision machine parts, tools, gloves, parts cleaners, and other auxiliary production materials and consumables used at onsite. When one takes into account micron-level size differences, there are as many as 80 sextillion (80 billion times 1 trillion) different products available. By using semi-finished products and optimizing inventory, the company can bring its offerings to the customer in as little as one or two days, achieving “reliable quick delivery.”

In addition, the “meviy” manufacturing ordering platform allows users to place orders for high-precision parts by requesting designs based on 3D CAD data, reducing the time and effort required to convert 3D data into 2D data, and its use is growing.

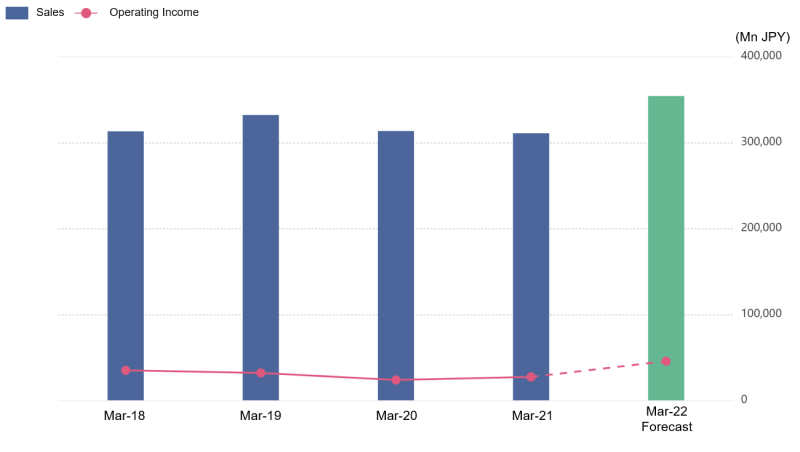

For the fiscal year ending March 31, 2022, MISUMI Group expects sales to increase by 13% YoY to JPY354bn and operating income to rise by 67% YoY to JPY45.5bn. In the financial results for the April-June period of 2021 (first quarter) announced at the end of July, sales and net profit both reached record highs. This was a result of strong sales of die components for FA in China and for the automotive industry, as well as demand for capital investment in the distribution (VONA) business in Japan and overseas. At the same time, the company upwardly revised its full-year forecasts.

Investment rating changed from “neutral” to “buy”

In a report on the machinery sector dated September 22, Goldman Sachs raised its investment rating of the MISUMI Group from “neutral” to “buy” and its price target from JPY4,000 to JPY6,000.The machinery sector as a whole, including FA, is expected to see a short-term reactionary decline during the next fiscal year due to advance orders stemming from tight supply and high demand. However, from the fiscal year after next onwards, the business environment is expected to respond to the “new normal” after the COVID-19 pandemic.

Goldman Sachs seems to have raised its investment rating of MISUMI Group, citing the rapid rise in profitability of its distribution business (VONA) and the revival of its FA and die components businesses, as well as the fact that the company’s business model is in line with the recent supply constraints.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/