Japan Markets ViewFocusing on Lasertec for its next-generation semiconductor mask blank inspection systems

Oct 07, 2021

Expectations are rising for “extreme ultraviolet (EUV) lithography,” which is indispensable for the miniaturization of semiconductor circuits. The ultra-high speed of data communication resulting from the introduction of the fifth generation mobile communication system (5G) will lead to higher functionality in smartphones and other devices, as well as higher performance in the semiconductors that support them. As semiconductors used in advanced devices require ultra-fine circuit line widths of 7 nm or less, the adoption of ultra-short wavelength EUV lithography technology is expanding in earnest. Although the most important lithography system is handled by ASML of the Netherlands, Lasertec Corporation (6920), which dominates the market for mask blank inspection systems, the material used to make semiconductor masks (photomasks), is also attracting a lot of attention.

■ De facto standard

Since a large number of IC chips can be made from a single photomask, many defective IC chips will be produced if the mask blank, the material used to manufacture the photomask, or the photomask, which is the original plate for the circuit pattern, has defects caused by adhesion of fine dust, scratches, or unevenness. Semiconductor device manufacturers would like to eliminate such defects; however, a certain number of defective products are produced. Therefore, inspection systems for semiconductor masks and mask blanks are needed to detect serious defects on mask blanks and photomasks and to improve the yield rate of IC chip manufacturing processes.

Lasertec’s main products are mask inspection systems and mask blank inspection systems for semiconductors, and the company has been selected as one of the “GNT (Global Niche Top) Companies Selection 100” for 2020 by the Ministry of Economy, Trade and Industry, which recognizes companies with high market shares and international competitiveness in specific fields. The company was the first in the world to commercialize semiconductor photomask inspection systems, and began selling EUV mask blank inspection systems in 2017. This technology is expected to become the de facto standard for the next generation of mask blank inspection systems.

■ Earnings expansion is likely to continue for some time

Lasertec is also expected to attract a lot of attention from foreign investors. The large-volume holdings statement (5% rule report) of WCM Investment Management LLC of the U.S. submitted to the Kanto Local Finance Bureau on September 22 revealed that the company had purchased more Lasertec stocks. The company holds 7,887,926 shares, equivalent to 8.37% of the outstanding shares. The purpose of holding is “investment in Japanese stocks for pure investment purposes.” At the time of the last submission on May 10, the company held 6,176,266 shares, equivalent to 6.55%, and has since bought about 1.71 million more shares. WCM Investment will attract attention for its global growth equity management. The company invests in companies based on their competitive advantages and corporate culture in order to generate long-term excess returns and limit the risk of market declines.

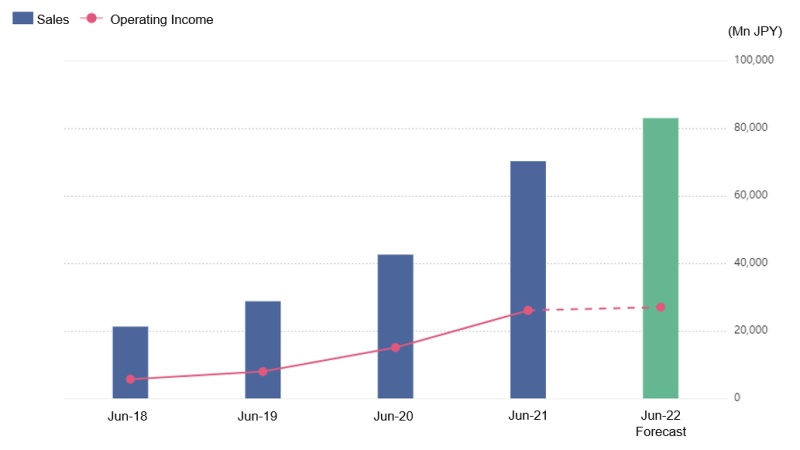

*Lasertec’s Earnings Results (company forecast for the fiscal year ending June 30, 2022)

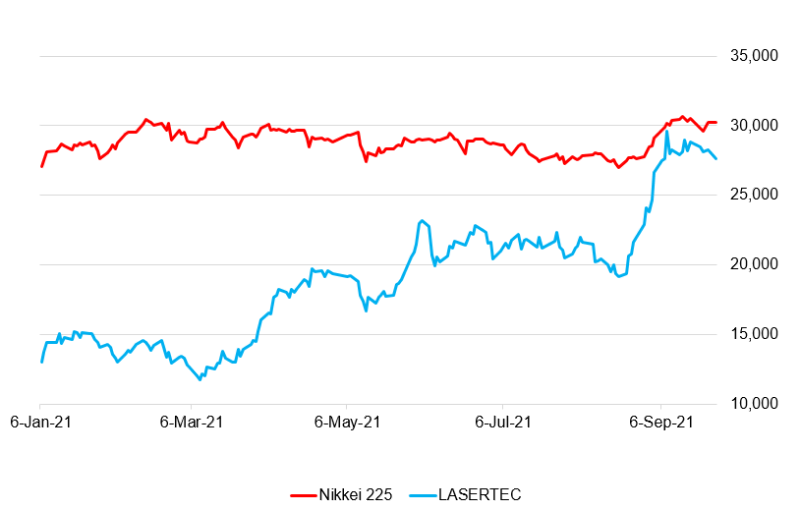

Lasertec’s consolidated financial results for the fiscal year ended June 30, 2021, announced in early August, showed a significant increase in both sales and profit, with sales up 65.0% from the previous fiscal year to JPY70.2bn and operating income up 73.1% to JPY26.0bn, far exceeding the company’s plan (sales of JPY62.0bn and operating income of JPY20.0bn). The forecast for the fiscal year ending June 30, 2022 was somewhat disappointing, as sales were expected to increase by 18.2% YoY to JPY83.0bn, while operating income was expected to increase only modestly by 3.6% to JPY27.0bn. However, considering that the results for the previous fiscal year were significantly higher than the initial forecast (sales of JPY57.0bn and operating income of JPY17.0bn), it seems conservative. Major semiconductor companies such as Taiwan Semiconductor Manufacturing Company Limited (TSMC) and South Korea’s Samsung Electronics Co., Ltd. are planning to enhance EUV-related investments in order to develop and mass-produce advanced semiconductors. Inquiries for the company’s inspection systems are expected to be strong, and the company’s earnings expansion phase is likely to continue for some time. As of September 28, the stock price was lingering around JPY28,000, but it is likely to gain momentum if it breaks through the psychological milestone of JPY30,000.

*Comparison of Lasertec’s stock price and Nikkei 225

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/