Japan Markets ViewCross-shareholdings Lowering Capital Efficiency

Jun 27, 2024

In the previous issue, we investigated the impact on prices of “stocks facing downward pressure” following the unwinding of cross-shareholdings. This issue features an examination of the “companies with a high cross-shareholding ratio.” Based on the data provided by QUICK, a financial information provider, we compiled the ratio of cross-shareholdings to book value of net assets (“cross-shareholding ratio”). As a result, we found that this type of shareholding has actually reduced capital efficiency. As the elimination of such holdings accelerates, companies with a high cross-shareholding ratio will likely be required to take action.

■Cross-Shareholdings’ Status and Relationship to Capital Profitability

Institutional investors, especially those outside Japan, are very critical of cross-shareholdings which are considered to lower a company’s capital efficiency and impair shareholder value. To verify this view, we analyzed the relationship between such shareholdings and financial indicators using QUICK’s data on cross-shareholdings.

■Cross-Shareholding Status by Sector

We calculated a cross-shareholding ratio by industry sector based on the most recent annual securities reports.

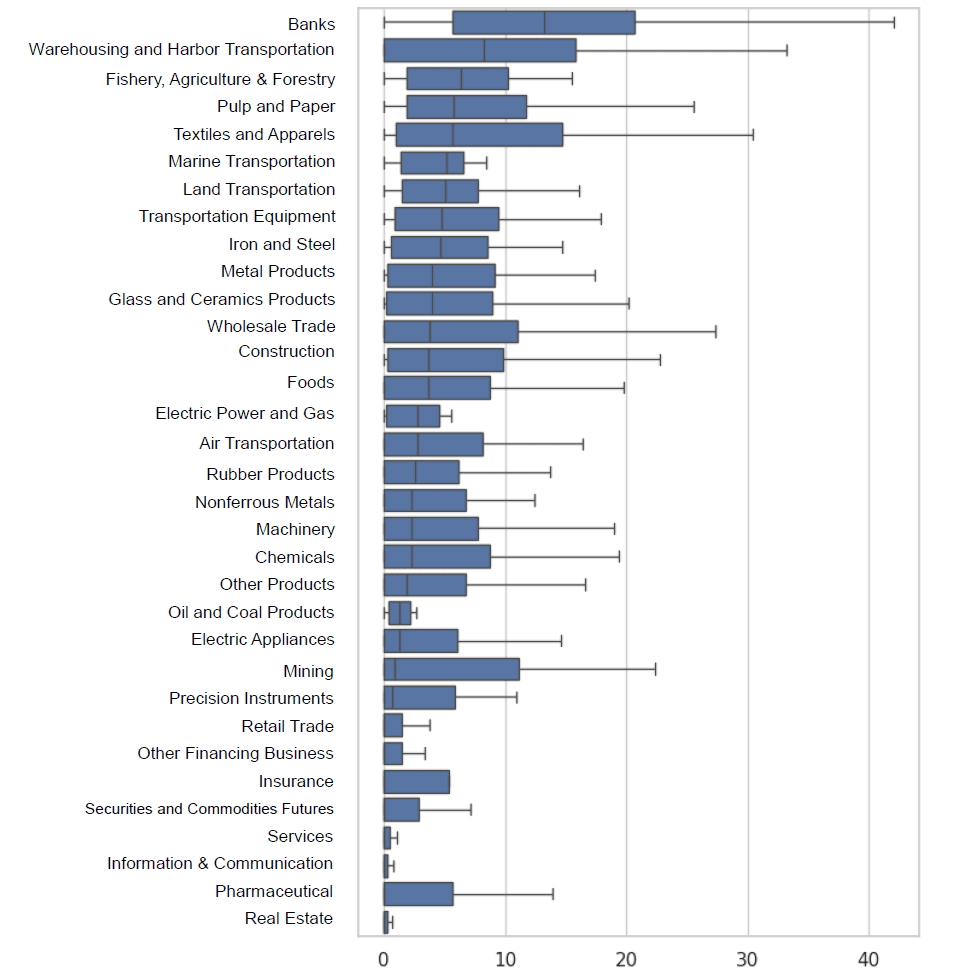

The box-and-whisker plots below show the distribution of cross-shareholding ratios of companies classified according to the Tokyo Stock Exchange’s (TSE) 33 industry sectors. The vertical axis shows the sector names, and the horizontal axis exhibits the cross-shareholding ratios. Companies are sorted in descending order of the median ratio.

* A box-and-whisker chart plots the “maximum,” “minimum,” “first quartile,” “median (second quartile),” and “third quartile” of the cross-shareholding ratios. A box (quartile range) shows the data distribution for the median 50%, and a whisker (line) indicates the full range of the data.

“Banks” have a high median cross-shareholding ratio with a high degree of variation. This indicates that many banks have a high cross-shareholding ratio but that the degree varies widely even within the same sector.

Based on the assumption that cross-shareholdings lower a company’s capital efficiency, the P/B ratio of the banking sector as a whole, which has many companies with a high cross-shareholding ratio, should also be low. In fact, when P/B ratio averages for individual sectors are calculated, banks have the lowest ratio, at approximately 0.47. In addition to banks, low P/B ratios can be seen in sectors with a high cross-shareholding ratio due to their low capital efficiency.

This analysis suggests that a high level of cross-shareholdings could worsen a company’s capital efficiency and thus impair shareholder value.

■Relationship between Cross-Shareholdings and Financial Indicators

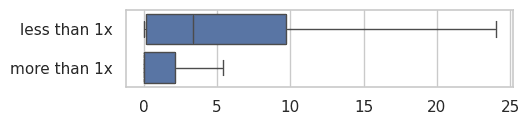

Let us take a look at the relationship between P/B ratios and cross-shareholdings. We divided Japanese listed companies into two groups: those with P/B ratios of less than one and those with one or more, and calculated the cross-shareholding ratios of the two groups. The results showed that the average cross-shareholding ratio was about 6.8% for companies with P/B ratios of less than one and about 2.5% for companies with P/B ratios of one or more. In other words, companies with a lower P/B ratio tend to have a higher cross-shareholding ratio.

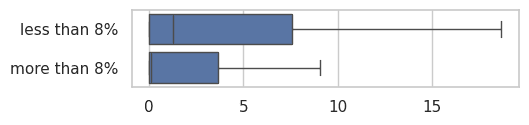

Next, we analyzed the relationship between ROEs and cross-shareholding ratios. We divided the listed companies in Japan into two groups, those with an ROE of less than 8% and those with an ROE of 8% or more, and compared their cross-shareholding ratios. The results showed that the former group had approximately 5.4%, while the latter had around 3.2%. Again, the lower the ROE, the higher the cross-shareholding ratio.

These results suggest that companies with a P/B ratio of less than one and low ROE tend to have a high cross-shareholding ratio. This indicates that such holdings are one of the factors that reduce capital efficiency.

■Stocks to Watch in Context of Cross-Shareholdings Elimination

These results show that cross-shareholdings are a factor behind low P/B ratios and ROEs. If companies sell their cross-held stocks, use the proceeds to return profits to shareholders, and invest in growth, they are expected to boost their stock prices and P/B ratios. In particular, companies with a high cross-shareholding ratio along with a low P/B ratio and ROE are likely to take some action in the future. We need to pay attention to these companies’ trends. The unwinding of cross-shareholdings will be the key to higher stock prices.

QUICK provides data on cross-shareholdings in a format that allows detailed analysis. The data is highly recommended for use in selecting stocks.

QUICK Data Factory: a marketplace for alternative data and applications in Japan

https://corporate.quick.co.jp/data-factory/en/

Contact us:

https://corporate.quick.co.jp/en/contact/form_service_en/