Japan Markets ViewCompanies’ Actions to Remain in TOPIX

Jun 30, 2025

[Keiichi Nakayama, QUICK Market Eyes] Companies have begun to take action to remain in the Tokyo Stock Price Index (TOPIX) in response to the revisions of the index promoted by the Japan Exchange Group (JPX, 8697). The next-generation TOPIX is designed to reduce the number of constituent stocks based on free-float adjusted market capitalization, excluding cross-shareholdings and other non-free-float shares.

Companies Aiming to Remain in TOPIX – Tanseisha’s Demonstrated Intent

Tanseisha (9743), which announced its February-April 2025 financial results on June 13, clearly expressed its intent to remain in the TOPIX. There is a possibility that more companies will take actions aimed at remaining in TOPIX in the future.

Tetsuo Tsukui, director of Tanseisha, clearly stated at a press conference in Tokyo on June 13, “We are working with the intention of remaining in the TOPIX.” The company has revised upward its earnings forecast for the fiscal year ending January 31, 2026 (current fiscal year), thanks to successful profitability management for its Expo 2025 Osaka Kansai projects. For the current fiscal year, Tanseisha expects increases in consolidated net sales of 9% YoY to JPY100 bn (previous estimate: up 7% to JPY98 bn), operating profit of 46% to JPY7.5 bn (previous estimate: up 17% to JPY6 bn), and net income of 34% to JPY5.2 bn (previous estimate: up 14% to JPY4.4 bn). Concurrently, the company announced a plan to increase its annual dividend to JPY70 (JPY35 for both interim and year-end dividends), a JPY10 increase from the previously planned JPY60.

The dividend payout ratio for this fiscal year is expected to be 63.5%, well above the company’s target of 50%. Director Tsukui recalled that “the high dividend yield was highly evaluated” in his repeated meetings with institutional investors. He then explained, “Management intends to continue to meet investors’ expectations,” in light of the company’s intention to remain in the TOPIX for the next fiscal year. The company also aims to discuss the appropriate level of capital adequacy ratio, invest in human resources, and enhance its visibility in the market. While there is concern in the market that the positive impact of the Expo has run its course, Tanseisha’s corporate actions, including the dividend increase, were noted as a surprise.

Next-Generation TOPIX: Fewer Constituents, Mechanism to Foster Corporate Competition

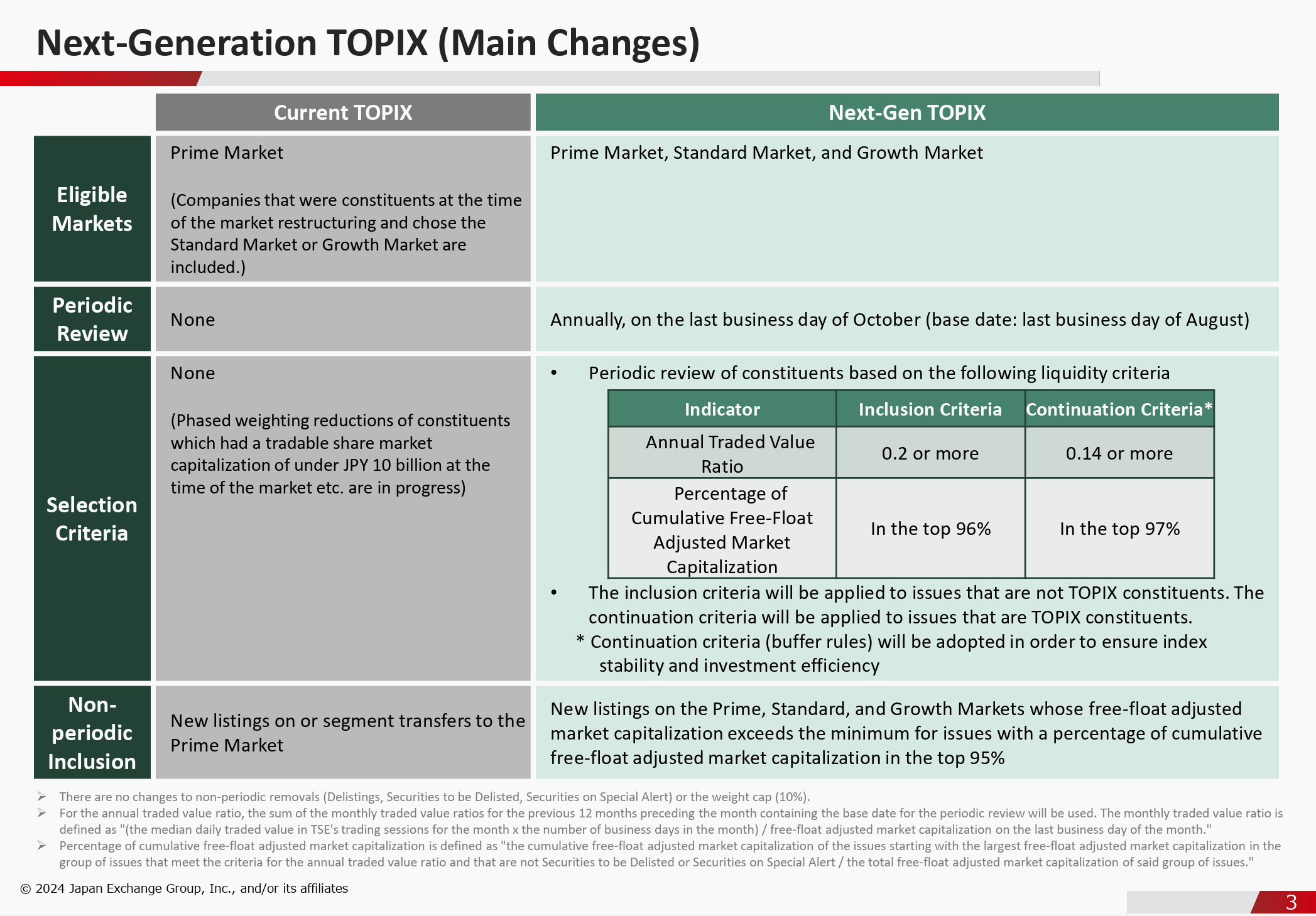

The revisions of TOPIX are part of JPX’s ongoing market restructuring. The aim is to enhance the index’s functionality while preserving its continuity. Stocks listed on the Standard and Growth Markets will also be included, and regular replacements will be made based on two liquidity criteria. The revised TOPIX is expected to have fewer constituents, and will incorporate a mechanism to foster competition among firms through periodic replacements. The first replacement is scheduled to be conducted in October 2026 with a base date for calculations at the end of August of that year.

Source: JPX Market Innovation & Research, “Overview of Revisions of TOPIX and Other Indices”

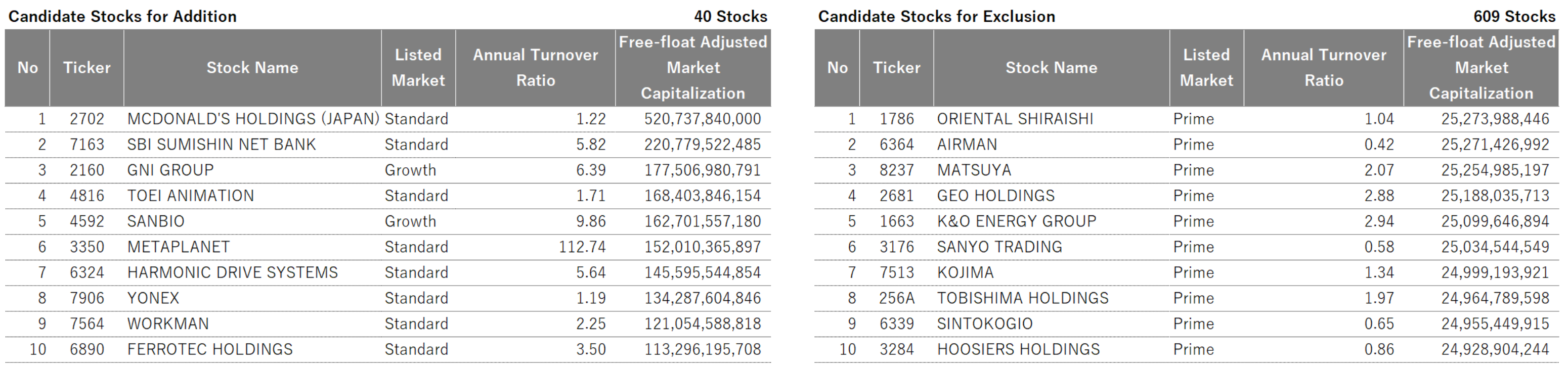

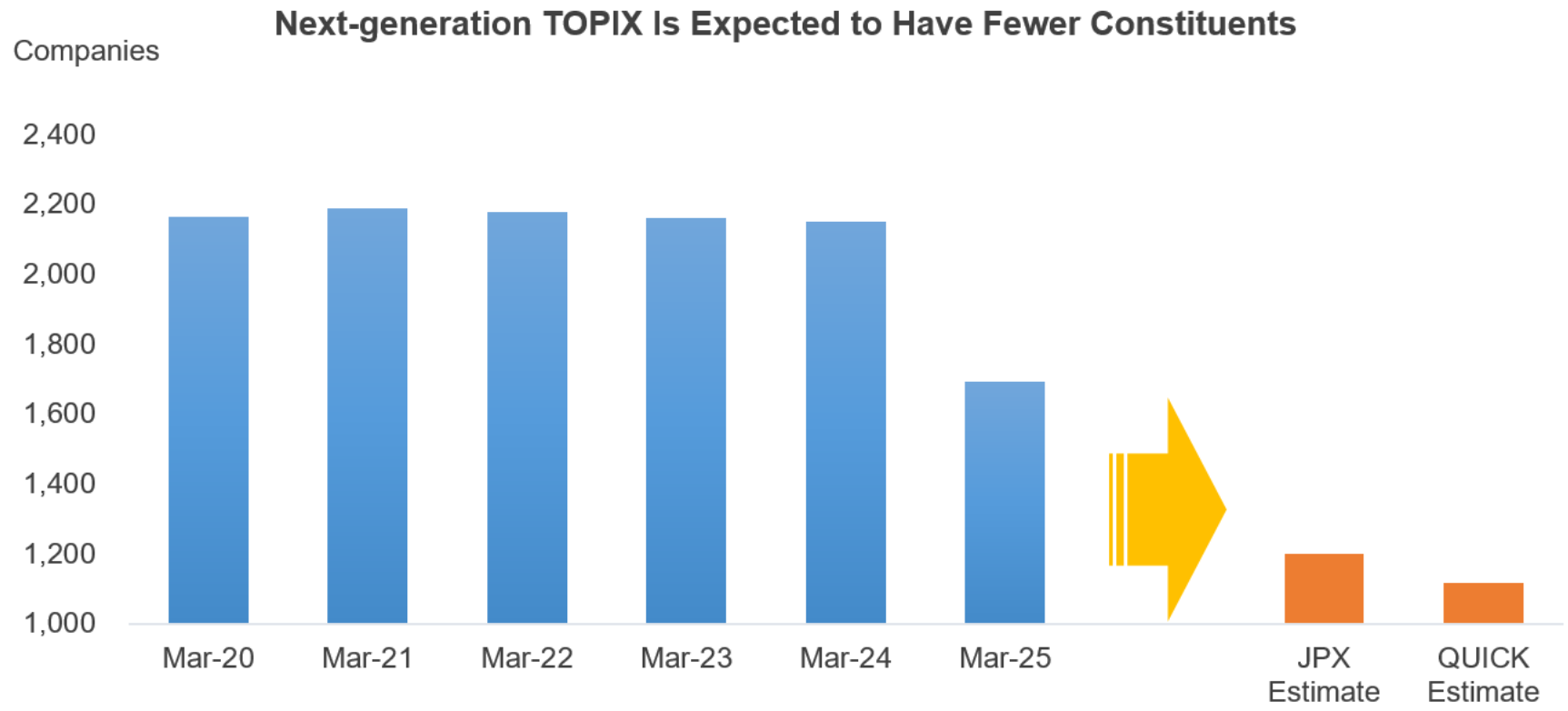

According to estimates by JPX Market Innovation & Research (JPXI), a JPX Group company, the number of TOPIX constituents will decrease to around 1,200 (as of the end of August 2024). Furthermore, QUICK’s “TOPIX Constituent Replacement Forecast,” provided for users of its financial information terminal “QUICK Workstation (Astra Manager),” indicates 40 candidate stocks for inclusion and 609 for exclusion as of June 18.

*Excerpt from “TOPIX Constituent Replacement Forecast,” a service exclusively for QUICK Workstation (Astra Manager)

*Compiled based on QUICK data. QUICK estimate is calculated based on the “TOPIX Constituent Replacement Forecast” service exclusively for QUICK Workstation (Astra Manager).

TOPIX Revisions: Crucial Underlying Theme Mentioned in Corporate Disclosures

Atsushi Kamio, senior researcher at Daiwa Institute of Research (DIR), pointed out, “The TOPIX revisions are a highly significant underlying theme, even though they have not become a major market theme.” He believes that in a market where investment based on corporate performance is highly competitive, it is crucial for mid-to-long-term investors to grasp themes that many others tend to overlook. Furthermore, Mr. Kamio noted, “Recently, an increasing number of companies have been mentioning the TOPIX revisions.”

In its May 27 financial results presentation materials, Yahagi Construction (1870), a major company in the Chubu region, explained the effects of its share offering that was announced in February. The company explicitly stated that “continued selection as a constituent of the next TOPIX is now in sight.” Seika Corporation (8061), a machinery trading company, also dedicated three pages in its financial results materials to explaining its “initiatives to remain in TOPIX.” Furthermore, system developer I’LL (3854) and private-pay nursing home operator Charm Care Corporation (6062) also referred to this in their disclosure materials.

Mr. Kamio of DIR stated, “Through interacting with companies, we found that several companies are considering the TOPIX revisions even though they do not mention it in their materials.” There is also a market view that “various actions will continue to emerge from companies wishing to remain in TOPIX” (according to Makoto Sengoku, senior equity market analyst at Tokai Tokyo Intelligence Laboratory).

Various market reforms have been progressing even after the TSE’s market restructuring in 2022. Numerous mechanisms are in place within the system to encourage corporate transformation, and corporate changes have the potential to create investment opportunities. We hope that increased corporate actions, including the TOPIX revisions, will lead to further enhancement of the overall market value.

(Reported on June 20)

If you’re interested in the data in this article, contact us

https://corporate.quick.co.jp/en/contact/form_service_en/

Related article

Is Corporate Action to Strengthen for 2nd Stage of TOPIX Revisions?