Japan Markets ViewChecking Stocks by Dividend Forecast towards the End of September

Sep 13, 2021

QUICK’s “Prediction of Dividend Forecast Revision” is an analysis tool that uses machine learning to predict the probability of a year-end dividend revision based on quarterly financial results and dividend revisions over the past 10 years. This tool models and calculates the trend of variables of individual stocks, such as the actual earnings results, cash flow, quarterly progress rate, and other financial results, before the actual increase (decrease) of dividends. Then, the tool predicts the probability of revising the dividend forecast from announcing the quarterly earnings to the next ones. We checked stocks with high expectations for dividend increases, as buying for interim dividends will boost the stock market towards the end of September.

■ Focus on dividend-related stocks and U.S. infrastructure-related stocks

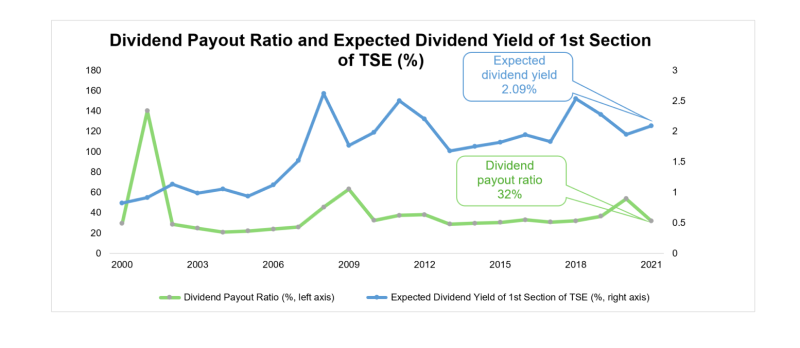

The expected dividend yield on the First Section of the Tokyo Stock Exchange is currently 2.09%, a high level over the 20 years since 2000. The dividend payout ratio, calculated based on the Nikkei forecast PER and expected dividend yield, is also 32%, leaving plenty of room for dividend increases. Mizuho Securities indicated in its strategy report dated September 20 that dividend-related stocks and U.S. infrastructure-related stocks should be in focus toward the end of September.

Japanese stocks continue to slump despite the announcement of strong earnings for the April-June quarter of 2021. However, dividend-related stocks have been focused recently. The effectiveness of dividend yields originally tends to be higher in August, following October, and there is still room for higher dividend yields in the marine transportation sector, which rose on the back of dividend increases and upward earnings revisions.

■ Ranking of top stocks in terms of prediction probability of dividend increases or decreases

At present, the expected dividend yield for the entire First Section of the Tokyo Stock Exchange is 2.1%, which is still higher than the yield on 10-year government bonds in Japan and the United States. As a result, there is a possibility that some domestic institutional investors will shift their bond investment funds to stocks, and some movement in aiming for interim dividends can be expected toward the end of September. While many companies have concerns about a slowdown in the profit growth rate in the next fiscal year in spite of their significant profit increase in the current fiscal year, companies that increase their dividends will be evaluated as those confident about their future performance.

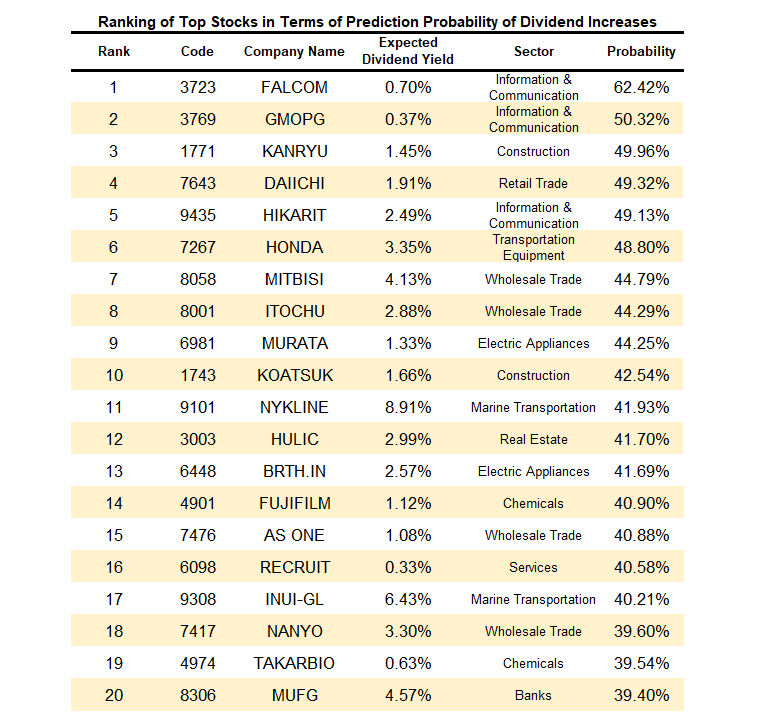

Domestic demand growth stocks with low dividend yields, such as Nihon Falcom (3723) and GMO Payment Gateway (3769) in the information and communication sector, were ranked high in the ranking of prediction probabilities for dividend increases.

However, the ratio of economy-sensitive sectors such as marine transportation, electric appliances, banks, and chemicals is high, and it is generally in line with the trend of sectors that exceeded market expectations or announced increases in dividends in the April-June 2021 financial results. Expectations for dividend increases are also high for stocks in the wholesale trade and marine transportation sectors, which many believe are still undervalued despite rising stock prices.

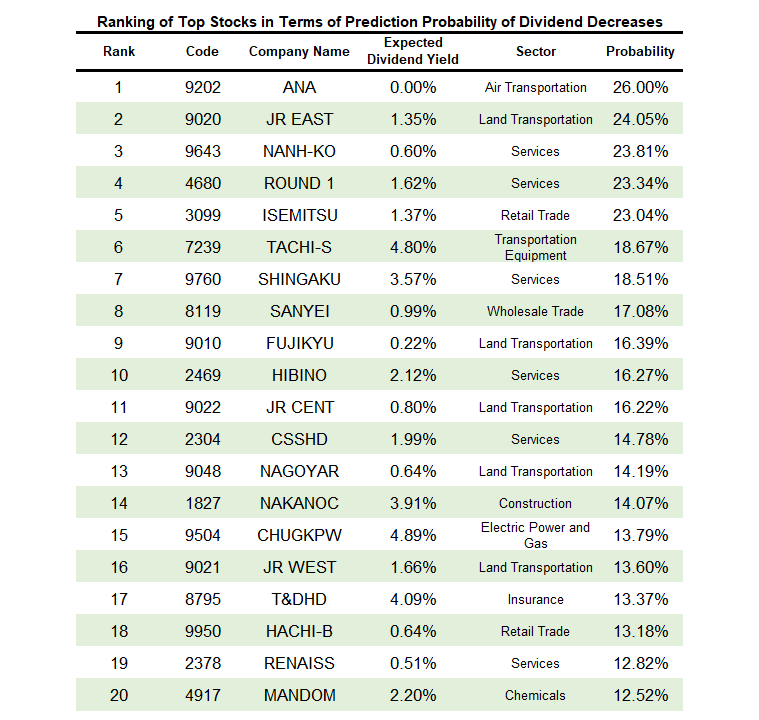

The top-ranked companies in terms of the prediction probability of dividend decreases were those related to Post COVID-19 such as the services and land transportation sectors. Although there is a trend to review Post COVID-19-related companies in anticipation of the peak out of COVID-19 spread in Japan by the end of 2021, dividend-oriented investors should continue to consider the possibility of dividend decreases.

What is the dividend payout ratio?

The dividend payout ratio is the percentage of net profit that is paid out as dividends and is also called the dividend payment rate. It may be based on net profit before taxes. A low dividend payout ratio indicates that the company can afford to dispose of its profits, meaning that it has a high retained earnings ratio.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/