Japan Markets ViewChanging Shareholders’ Meetings with Increased Shareholder Proposals

May 29, 2024

[QUICK Market Eyes] The June shareholders’ meeting season is just around the corner. Shareholders’ meetings used to be formal and brief events with little discussion. Nowadays, however, they are turning into a place for dialogue (engagement) between shareholders and companies. With the recent increase in shareholder proposals, these meetings are likely to become a forum for management decision-making as well. Looking ahead, tightening criteria for institutional investors’ exercise of voting rights may change corporate management in Japan.

At the press conference held in Tokyo on April 20, Seth Fischer, Chief Investment Officer (CIO) at Oasis Management, a Hong Kong-based investment fund known to be an activist investor, told reporters, “This is an important season for shareholders to meet with management and ask for accountability from companies.”

In recent years, the number of outside directors has increased, and more companies have established nominating and compensation committees. Mr. Fischer commended this trend as having improved governance in Japanese companies. On the other hand, he stressed, “Now is the time to shift from holding a formal meeting to focusing on the content.” At this year’s shareholders’ meeting, Mr. Fischer intends to propose the dismissal of Sekio Kishimoto, President and CEO, and outside directors of Hokuetsu Corporation (3865), in which he holds approximately 18% of outstanding shares. In addition, he will propose the nomination of new candidates for outside directors. In addition, he will ask Kumagai Gumi (1861), a quasi-major general construction company, to increase its dividend.

At Hokuetsu Corporation’s shareholders’ meeting in 2023, the percentage in favor of President Kishimoto’s reappointment was 65.13%, down from the previous time in 2021 (80.21%). When Fischer was asked whether other shareholders would support the Oasis proposal at Hokuetsu Corporation’s shareholders’ meeting this time, he replied, “It is a very important issue.” He then stated, “We hope that more shareholders will vote in favor of our proposal so that it will pass.” As for Kumagai Gumi, he cited the mid-term plan announced on May 14 as an example, “Kumagai Gumi has not yet achieved its mid-term management plan to date, making it difficult to trust the company.”

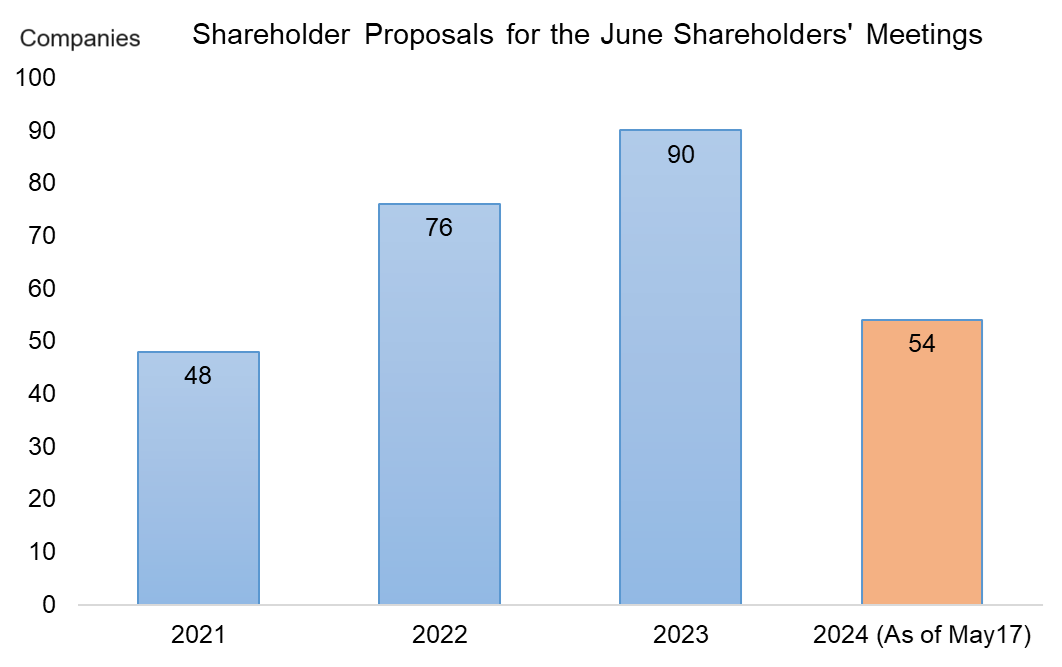

■ Growing Number of Shareholder Proposals with 54 as of May 17 – Shareholders’ Meetings as a Place for Management Decisions

Shareholder proposals have seen an increase in recent years. According to Daiwa Institute of Research (DIR), as of May 17, 54 companies (excluding two companies with withdrawn proposals) received shareholder proposals for their shareholders’ meetings to be held in June. The number is expected to increase when shareholder proposals on climate change issues and proposals by individual investors are counted.

* Compiled by DIR

Hidenori Yoshikawa, a chief consultant at DIR, pointed out, “Shareholders’ meetings have changed from a short and formal event to a more open place to hold dialogue with a sense of tension.” He also noted, “Shareholder proposals with an awareness of corporate value may increase further, making shareholders’ meetings a place for management decision-making.”

Institutional investors in Japan are also gradually tightening their criteria for exercising voting rights. In February, Nissay Asset Management changed its criteria for exercising voting rights. Effective June 2025, the company will oppose appointing a representative director for any company with a corporate P/B ratio of less than one that fails to take “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” as requested by the Tokyo Stock Exchange (TSE). Nissay Asset Management also stated that, in principle, it would be in favor of proposals requiring disclosure of “material contracts,” cancellation of treasury stock, and proposals for disclosure of the cost of shareholders’ equity if corporate responses are deemed inadequate.

Mitsubishi UFJ Trust and Banking has changed its voting criteria, effective April, to oppose reappointing a representative director for any company whose return on equity (ROE) has been below a certain level (5%) for the past three consecutive fiscal years, which is deemed to be a management responsibility with no improvement expected in the future. The company plans to raise the ROE standard to 8%, starting with TOPIX 500 constituents from April 2027, and to further expand the scope of its application.

Morgan Stanley MUFG Securities released a report titled “Japan’s Revival” on May 19. Equity strategist Tim Chang shared his insights in the investment strategy section of the report, focusing on corporate governance. Mr. Chang noted, “Japan’s recent corporate governance reforms are significant, influential, and likely to be a harbinger of rising stock prices.” On the other hand, he expressed his view, “We still need to keep a close eye on whether companies can continue to take measures to enhance profitability over the long term, such as strengthening and restructuring their business portfolios.”

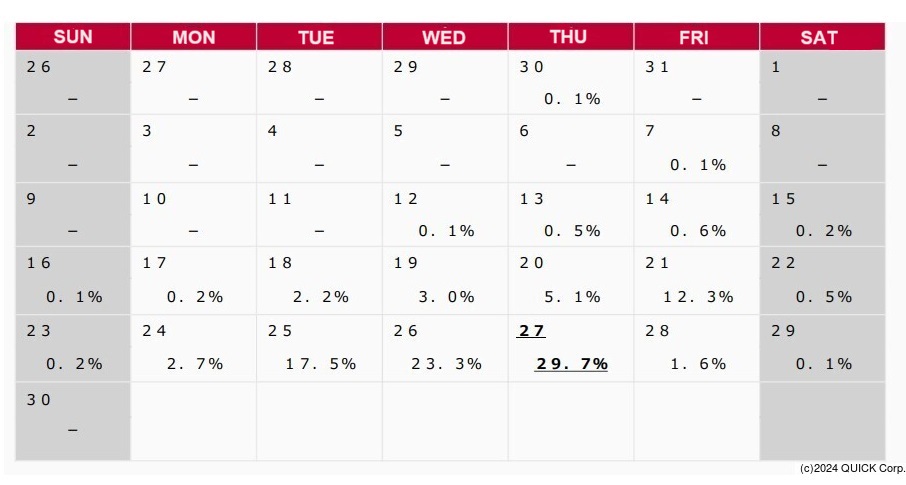

■ Shareholders’ Meetings to Peak on June 27

On April 25, the TSE released the results of a survey on trends in the holding of annual shareholders’ meetings of companies with the fiscal year ending March 31, 2024 (survey period: April 3-23, 2024). The survey revealed that this year’s annual shareholders’ meetings will be most concentrated on June 27. Of the companies surveyed, 29.7% will hold their annual shareholders’ meetings on June 27, and 23.3% on June 26, one day earlier.

* Source: TSE, “Trends in Annual Shareholders’ Meetings of Companies with Fiscal Year Ending March 31, 2024”

An increasing number of companies are receiving shareholder proposals from activist investors, including Oasis. Annual shareholders’ meetings are turning into a place where corporate value is being questioned.

(Reported on May 22)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/