Japan Markets ViewChanging Annual General Meetings and Stricter Eyes of Japanese Institutional Investors

Jun 09, 2025

[Keiichi Nakayama, QUICK Market Eyes] Annual general meetings (AGMs) of companies whose fiscal year ends in March are about to begin. In the past, AGMs in Japan were brief events with no Q&A or discussion. However, they are now becoming a forum for serious dialogue between companies and their shareholders with a sense of tension. Japanese asset management companies, which are institutional investors, have revised their criteria for exercising voting rights, and are now taking a stricter look at such factors as return on equity (ROE). AGMs are becoming increasingly important.

Dispersal of Meeting Dates, Electronic Advance Voting Rights Exercise, and Many Other Formal Changes

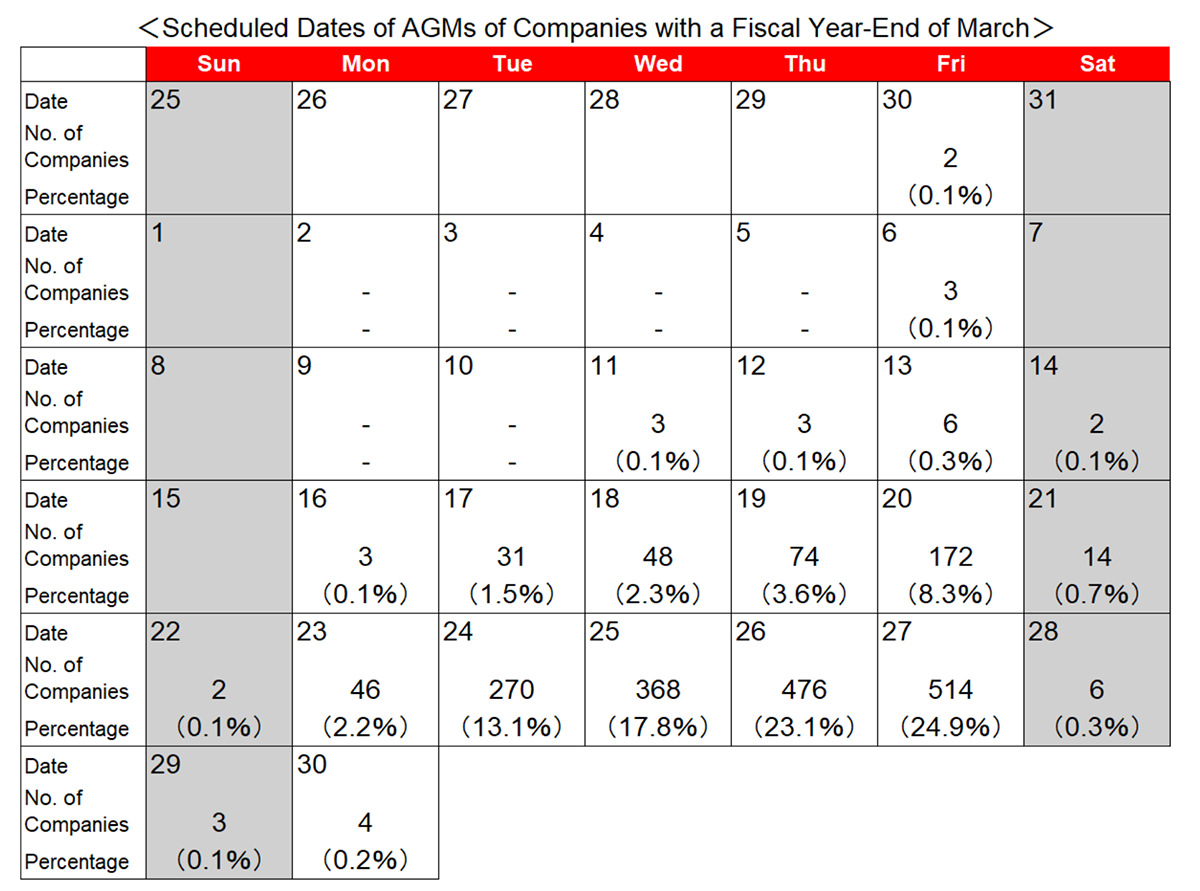

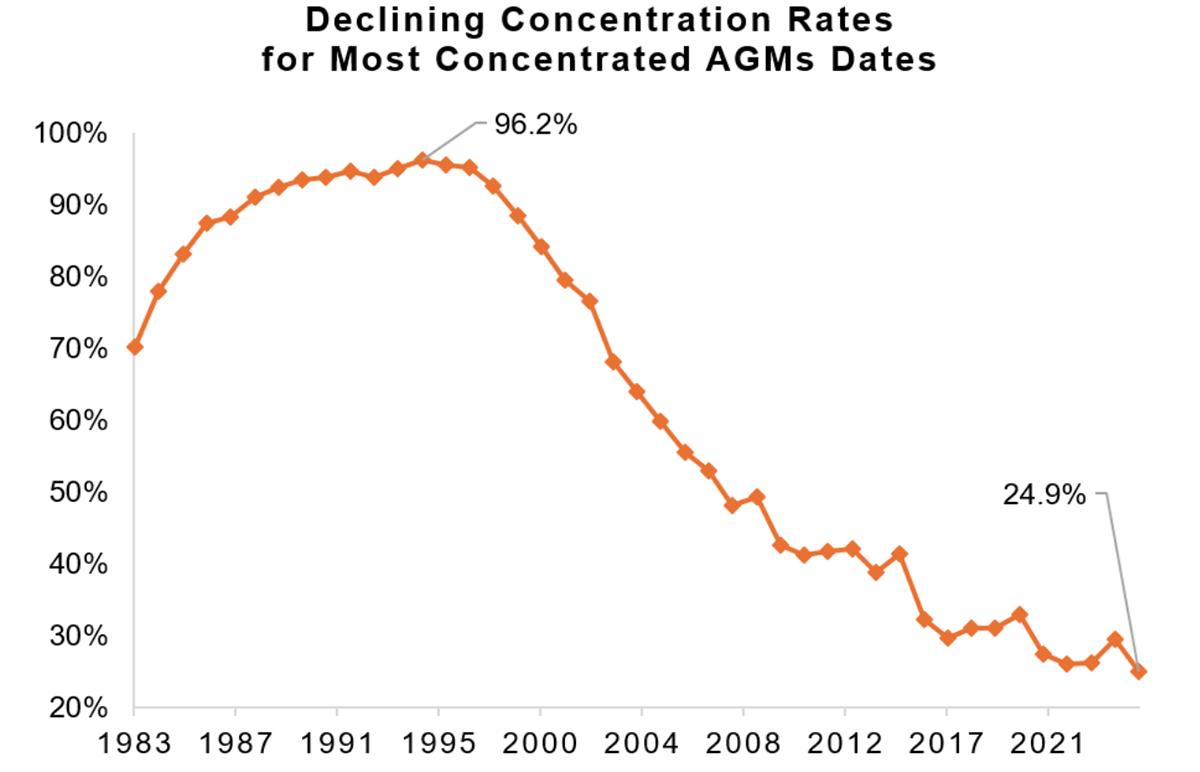

The “format” of AGMs is undergoing significant changes. One of such changes is the dispersion of meeting dates, which used to be concentrated on specific dates in late June. In 2025, the most concentrated date of AGMs will be June 27, when 514 companies are scheduled to hold the meetings. While the trend that the meetings are concentrated in the latter half of June remains unchanged, companies that will hold AGMs on June 27 will account for 24.9% of the total in 2025. According to the Tokyo Stock Exchange (TSE), the rate of concentration on June 27 reached as high as 96% in 1995. However, the rate declined markedly after 2000, and 2025 will see the largest dispersion of AGMs.

* Compiled based on TSE’s data, Target: 2064 companies including 14 companies with undecided dates as of May 16

* Compiled based on TSE’s data

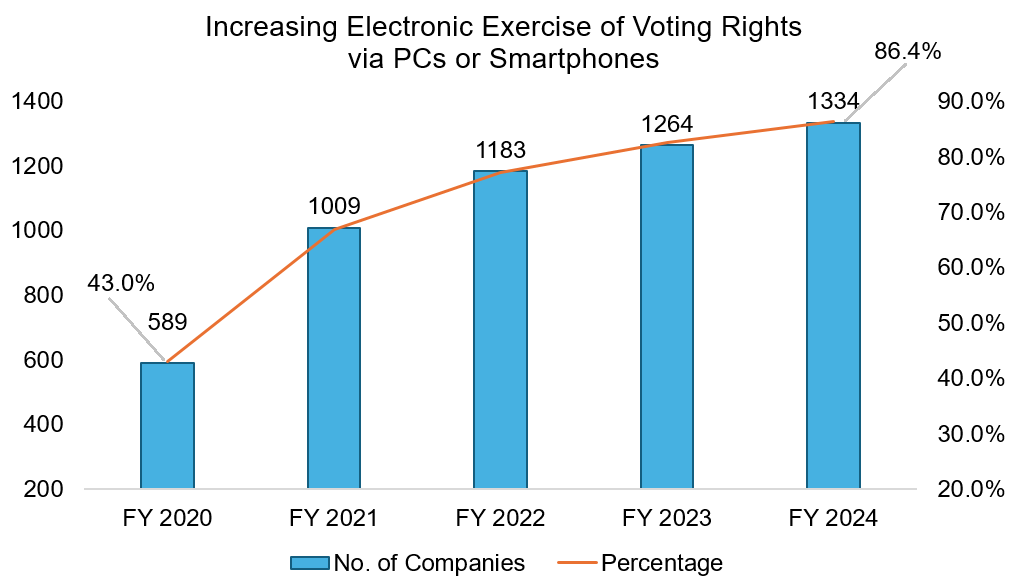

Electronic exercise of voting rights at AGMs is also progressing. According to Sumitomo Mitsui Trust Bank, more than 80% of the companies that have entrusted the bank with the aggregation of their voting rights have adopted electronic exercise of voting rights via PCs or smartphones in advance of AGMs in recent years. Most recently, the percentage of electronic exercise has also exceeded that of the exercise of voting rights in written form.

* Compiled based on the data of Sumitomo Mitsui Trust Bank

Shift from Place for Communication to Dialogue and Changes in Criteria of Japanese Institutional Investors

Regarding the recent trend of AGMs, Mizuki Suma, head of the Legal & Governance Team at Sumitomo Mitsui Trust Bank, commented, “I have a firsthand sense that an increasing number of companies are holding AGMs with an emphasis on fan building and dialogue.” At AGMs, some companies omit formal explanations, such as the report of the board of corporate auditors and the quorum for voting, while others provide fuller explanations of medium-term management plans and other matters, according to Ms. Suma.

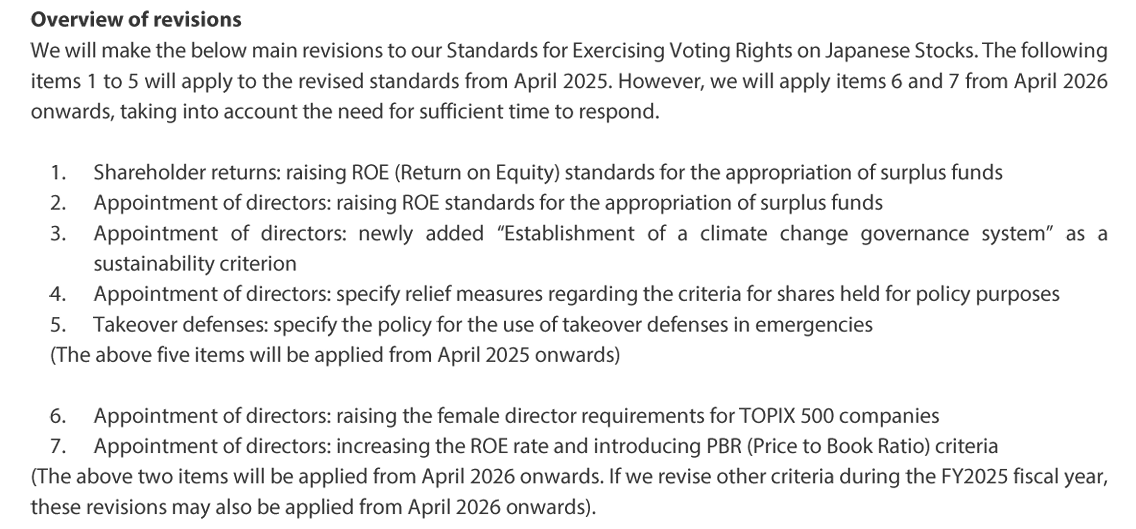

The criteria for exercising voting rights by Japanese institutional investors are gradually changing. There are trends toward stricter standards for female director representation, higher performance standards for appointing directors, and increased return on equity (ROE) levels for cash-rich companies. Nikko Asset Management, which revised its criteria for exercising voting rights in February, has raised the ROE threshold for whether or not to oppose a proposal for appropriating surplus funds and appointing related directors.

* For more details: Revisions to Nikko AM’s Standards for Exercising Voting Rights on Japanese Stocks

Kazuya Nakagawa, head of the ESG team at Nomura Securities, stated, “Asset owners and others are taking a harder look at the ROE of Japanese companies,” amid the TSE’s requests to take “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price.” Mr. Nakagawa also noted that one of the most noteworthy aspects of this year’s AGMs is the large number of shareholder proposals. He believes that companies with a low P/B ratio are more likely to receive shareholder proposals. Mr. Nakagawa also considers that “the number of companies receiving shareholder proposals is likely to reach the 100-company mark in the end, up from the 91 companies in the previous year.”

One market participant noted, “The tension at AGMs is rising because companies are taking off a certain kind of armor to protect themselves as a result of the reduction of cross-shareholdings.” The importance of AGMs is increasing year by year as a forum for serious dialogue between companies removing their protective armor and their shareholders.

(Reported on May 27)

Shareholders’ Meeting Resolution Data (EDINET)

https://corporate.quick.co.jp/data-factory/en/product/data051/

If you are looking for datasets unique to the Japanese equity market, visit QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/