Japan Markets ViewApproaching End of September with Complex Supply-Demand Balance

Sep 24, 2024

The end of September is approaching, a time when supply and are demand intricately intertwined. Corporate share buybacks, which have statistically been a major support for Japanese stocks until recently, are likely to be missing. There are also concerns about deteriorating supply-demand balance ahead of major initial public offerings (IPOs) in October. On the other hand, reinvestment of dividends and trading in connection with changes in the Nikkei 225’s constituents are likely to underpin the market.

Fumio Matsumoto, chief strategist at Okasan Securities, noted, “The fluctuation range will be large for a while, and supply and demand will be somewhat slack in the second half of September and into October.” In particular, Mr. Matsumoto predicts that the share buybacks that have supported Japanese stocks will be held back. In addition, he expects deteriorating supply-demand balance in connection with major initial public offerings (IPOs).

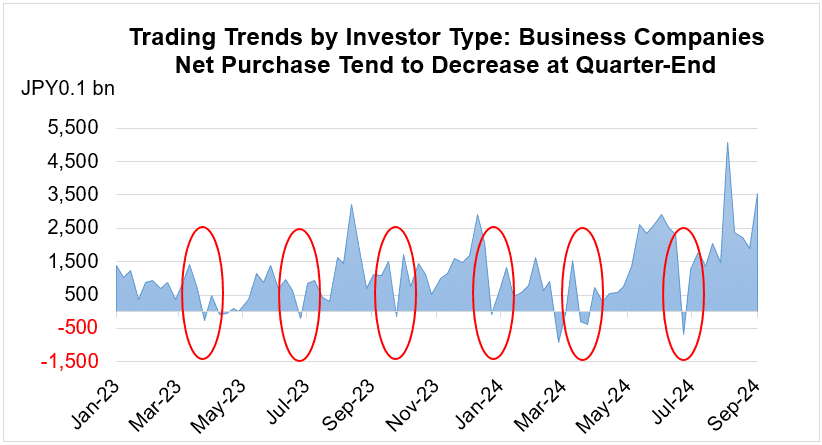

Companies tend to hold off on share buybacks at a quarter-end. This is because the guidelines for share buybacks set forth by the Japan Exchange Group’s self-regulatory organization include a section concerning “purchases at the end of the fiscal year” as an action to be monitored closely. This section applies to the five business days prior to the end of a fiscal year. Although the guidelines are not mandatory, many companies comply with them, and the amount of net purchases by business companies tends to decrease during this period.

*Compiled based on QUICK data, total of cash and futures

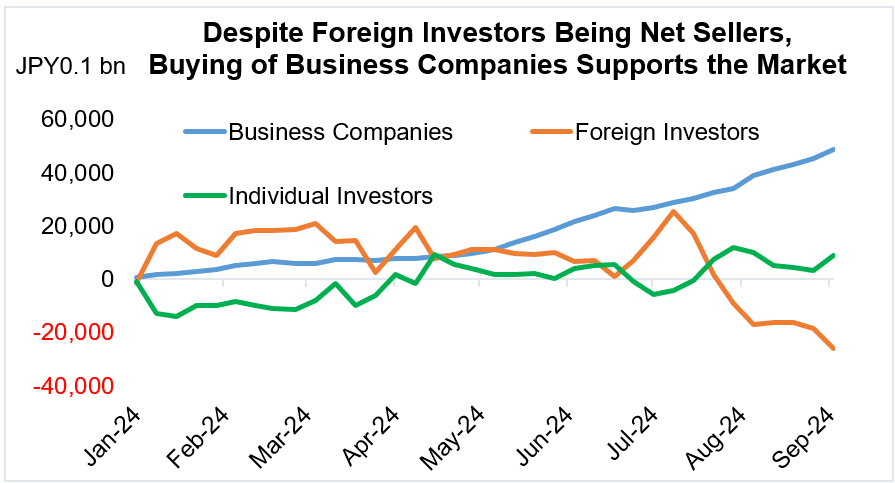

*Compiled based on QUICK data, total of cash and futures

In October, Tokyo Metro and Kioxia Holdings, a leading semiconductor memory company, are scheduled to conduct IPOs. Mr. Matsumoto of Okasan Securities also pointed out, “If the two IPOs release about 30% of their shares on the market, they will siphon off over JPY600 bn. from the market, or over JPY1 tn assuming the release of 50% of their shares.” Another market participant (trader) is also “wary of the possibility of sector rebalancing redemption sales resulting from the two IPOs.”

Meanwhile, special supply and demand support the market at the end of September. Specifically. September 26 is the final trading day of shares with dividend rights mainly for companies closing at the end of March, and the following day, September 27, is the ex-dividend date. During the two days, passive investors reinvest dividends to avoid as much as possible the tracking error associated with the ex-dividend.

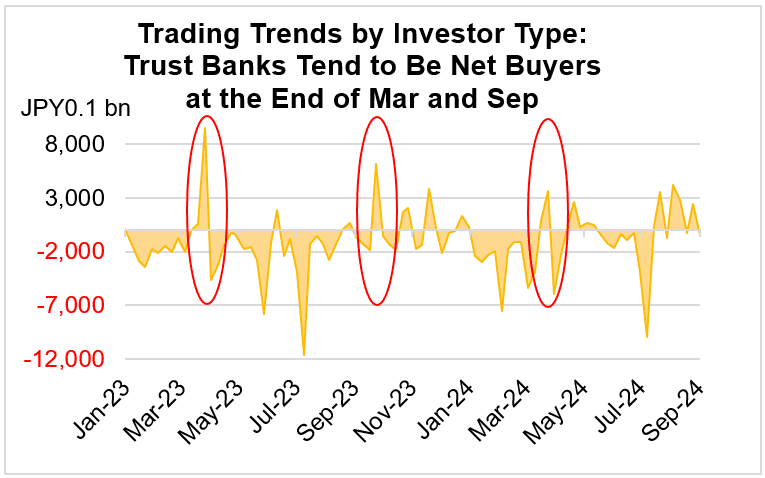

Takehiko Masuzawa, trading head at Phillip Securities Japan, estimates that buying demand for the purpose of dividend reinvestment will amount to about JPY1.2 tn. Looking at trading trends by investor type, trust banks are the most prominent buyers at the end of March and September. Additionally, the Nikkei 225 is expected to see a broad-based buying demand of around JPY170 bn at the end of September due to its replacement of the constituent stocks.

*Compiled based on QUICK data, total of cash and futures

Some expect the supply-demand balance to deteriorate in early October due to Japanese financial institutions’ “profit-taking sales at the beginning of the fiscal year” after the complex supply-demand situation at the end of September. According to a Japanese securities strategist, “Although the market level is lower than in April, it is hard to assume that no profit-taking will take place.”

It is widely assumed that share buybacks, which are the largest buyers in 2024, will once again support the market following the complex supply-demand period. Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory, predicts that “many corporate share buyback resolutions tend to be made in November as well, and the high level of resolutions will continue.”

Mr. Matsumoto of Okasan Securities commented, “We do not expect high levels of share buybacks to continue indefinitely, but we have factored in the effect of higher EPS in our market forecast.” Rising interest rates due to the Bank of Japan’s monetary policy normalization will negatively impact the price-to-earnings ratio (“P/E ratio”). However, given the improvement in long-term EPS, he sees September and October as “a good time to build up a position in Japanese stocks for 2025, when supply and demand are expected to ease.”

On September 27, the Liberal Democratic Party’s presidential election will be held, with nine candidates running. Some expect that the House of Representatives will be dissolved for a general election in October at the earliest. As an anomaly, there are growing expectations that the “dissolution will stimulate equity investment.” In the near term, the market may continue to experience ups and downs due to the complex supply-demand balance and political events. Nevertheless, it may be time to consider the market’s long-term supply-demand structure as well.

(Reported on September 19)

Related dataset

QUICK Licensed News: QUICK original news on the Japanese market

https://corporate.quick.co.jp/data-factory/en/product/data016/