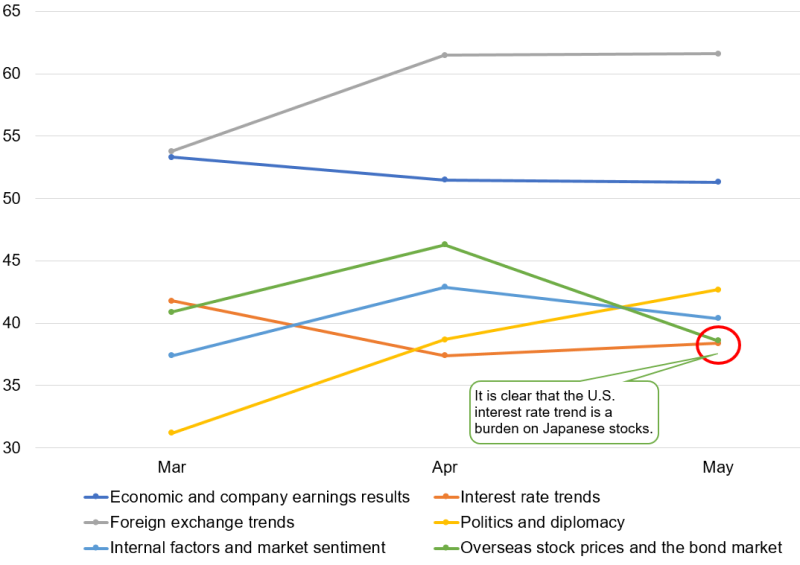

According to the QUICK Monthly Survey (Equity) in May 2022, the entry into the profit-driven market has been a dud, with interest rate trends casting a shadow over investor sentiment. Participants focusing on “Interest rate trends” as the fluctuation factor for the stock price accounted for 26%, rising 10 points from the previous month, while those focusing on “Economic and company earnings results,” though the most popular, stood at 48%, falling 2 points from the previous month. The index base, which indicates the impact on the market, also declined slightly from the previous month to 51.3.

Looking at position trends, there is no impression that there is a growing momentum to drastically accumulate or liquidate the position. As for the investment stance for the time being, while 70% of respondents chose “Maintain the status quo,” down 14 points from the previous month, “Increase slightly” and “Decrease slightly” both accounted for 15%, indicating that overall, significant changes in the investment stance are likely to be limited.

One of the reasons that earnings performance is not a decisive factor is that it tends to vary across industries and stocks. Looking at earnings forecasts for the current fiscal year, many industries with top-line growth potential, particularly semiconductors and energy-related industries, are expected to increase in both sales and profits. Take, for example, Tokyo Electron (8035), a semiconductor production equipment company. In addition to strong demand, procurement is mainly domestic, and the impact of parts shortages is expected to be suppressed, resulting in record-high profits for the current fiscal year.

INPEX (1605), whose end of the fiscal period is in December, has revised its oil price assumptions in response to rising crude oil prices, and during the January-to-March period, has already upwardly revised its full-year forecasts.

On the other hand, there are companies for which demand is strong but the supply system is a bottleneck. Among major automakers, Toyota Motor (7203) is expected to increase its revenue with a record-high global production of 9.7 million units. However, due to deteriorating profitability caused by high prices of a wide range of raw materials such as steel and nonferrous metal resins, the company forecasts a 20% YoY decrease in operating income for the fiscal year ending March 31, 2023 (under International Financial Reporting Standards) to JPY2.4 tn. While there is room for upside due to foreign exchange assumptions and other factors, there are also many uncertainties. Risks also persist over parts procurement. In retrospect, the automobile giants had shown a willingness to increase production. However, their plans to increase production have been thwarted two or three times because they have not been able to procure parts and materials as they had hoped.

Even though demand is strong for major factory automation (FA) and gaming equipment companies, there is no denying that the supply side of the market may be a burden. However, there are examples such as Topcon (7732), which is involved in surveying instruments. Topcon aims for record-high operating income this fiscal year by minimizing supply constraints by reviewing product designs and other measures, as well as strong demand. Although this is a downward swing compared to the target of the medium-term management plan (JPY20bn), the current environment may be favorable for forecasting the company’s efforts as well as its ability to cope with adversity.

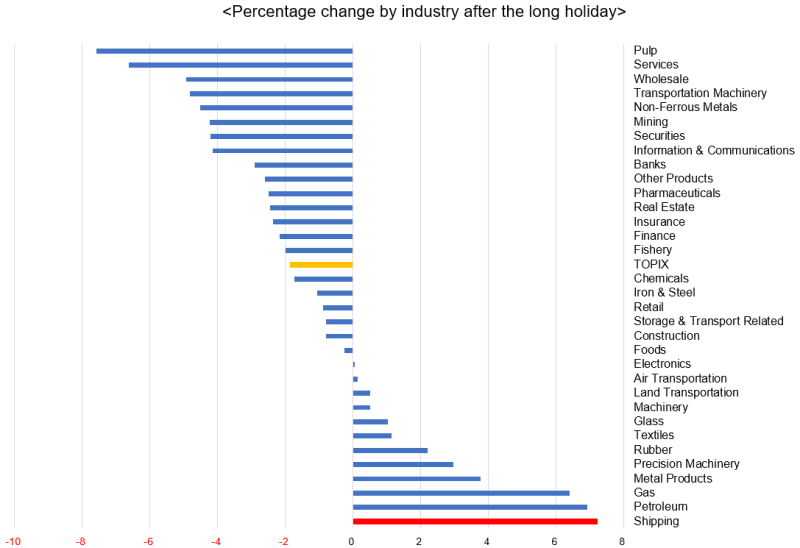

In addition, given the uncertain business environment, it may be effective in the near term to aim for a stable run with stocks that are relatively superior in terms of stable cash flow and shareholder returns. According to the ranking of the percentage change in stock prices by industry from April 28 to May 13, the top gainer was the “shipping industry.”

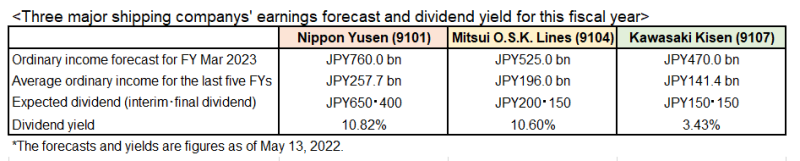

Looking at the three major shipping companies, despite the expected decrease in profit, they expect a higher level of earnings than in the past due to the high profitability in the containership business. For example, at Nippon Yusen (9101), the premise is that the liner trade business, including the containership business of Ocean Network Express (ONE), generates more than 70% of ordinary income.

While the increased dependence on containerships and the strong possibility of earnings peaking out in the second half of the year and beyond are risks, the current dividend yields of over 10% forecasted for this fiscal year for Nippon Yusen and Mitsui O.S.K. Lines (9104) are attractive.

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/