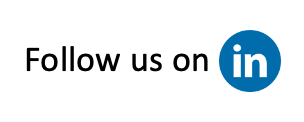

QUICK Monthly Survey (Equity) in March was conducted in the midst of escalating Russia’s invasion of Ukraine, and the results strongly reflected the impact of geopolitical risks. In terms of stock price fluctuation factors, participants focusing on “Politics and diplomacy” jumped 29 points to 31%, just behind “Economic and company earnings results.”

*Based on QUICK Monthly Survey (Equity)

It should not be overlooked that Russia and Ukraine are resource-rich countries and rich breadbaskets, which also have a significant impact on the global economy. The Thomson Reuters Core Commodity CRB Index, which shows the overall price movements of commodity markets, has been up 25% since the beginning of 2022. The rising inflation risk can easily be associated with tightening monetary policy in the US, and the stock market has all the factors for stronger headwinds.

In particular, the large price hikes in upstream raw materials are a downside concern for Japanese companies. Further delays in the recovery of supply chains damaged by the COVID-19 infection are also a risk. In February, parts shortages were particularly massive among the major automobile manufacturers in the North American market, with sales down by more than 10% at Toyota Motor (7203) and by more than 20% at Honda Motor (7267). Hopes for a recovery in production have been lost, and the stock market seems to lack signs for the buyback.

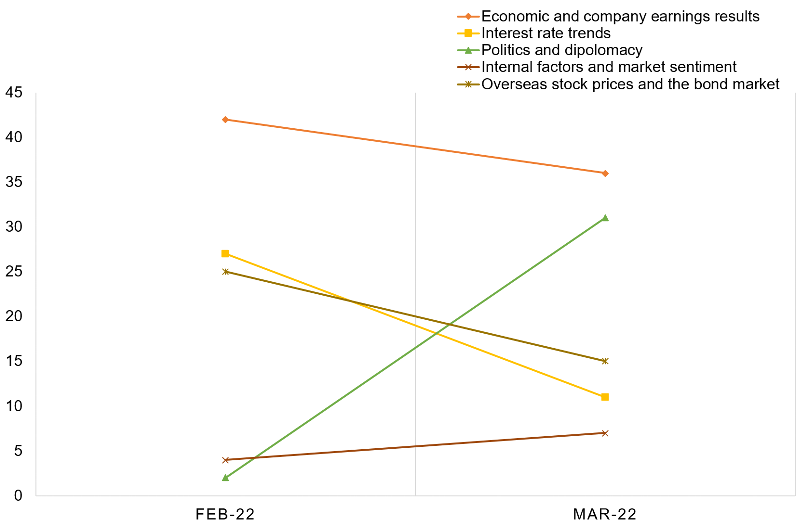

In fact, on the question asking about investment stance by sector, the “overweight” minus the “underweight” was plus 6% for “automobiles,” a drop of 15 points, although overweight is still a majority.

*Based on QUICK Monthly Survey (Equity)

“Electrical & Precision” also turned “underweight,” at -6%. In addition to the dominance of upstream industries such as “materials,” “communications,” which has generally been unaffected by high raw material prices and overseas situations, rose 3 points to 14%, giving the impression that the impact of increased raw material prices has become more serious.

The high dependence on fossil fuels has been highlighted as a risk, and securing clean energy is likely to become more critical as a practical rather than an ideal issue.

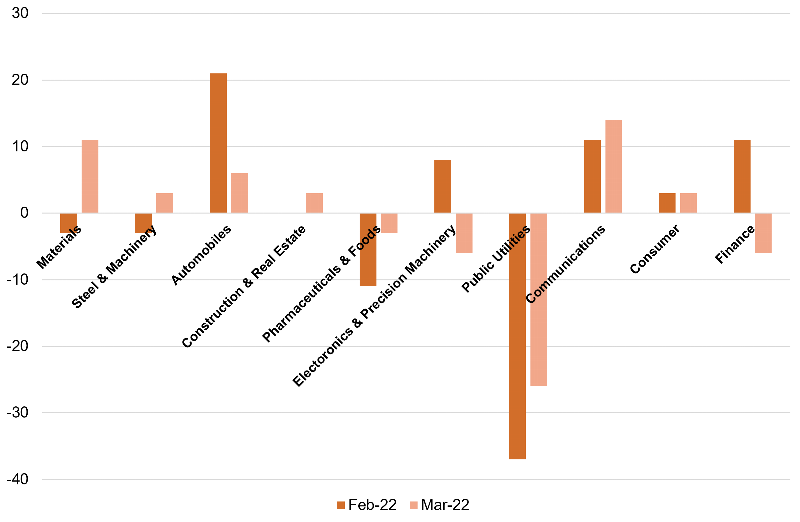

Infrastructure funds that invest in power plants and other social infrastructure should be focused on. Tokyo Stock Exchange (TSE) has been calculating the Infrastructure Funds Index since April 2020. Compared to the end of 2021, the price has been stable against TOPIX.

*Relative chart with December 30, 2021 as 100.

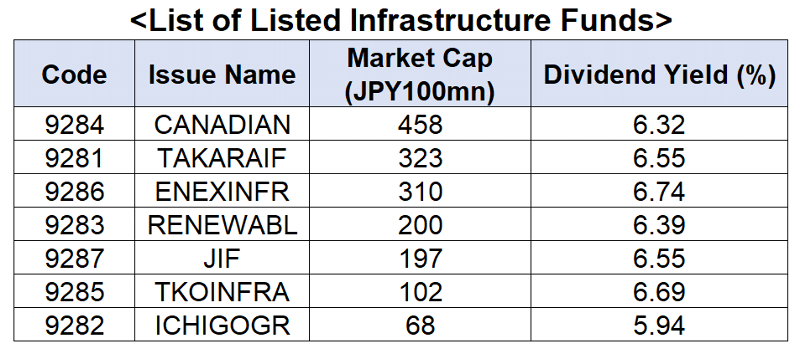

There are currently seven infrastructure funds listed on the TSE. All of them are unique in that they invest in renewable energy. Another thing to note is the high yields, all-around 6%.

Infrastructure funds acquire solar power generation equipment and other assets with funds collected from investors and lease them out to third parties. The rent becomes revenue, and dividends are given to investors who provide funds. The system is similar to REIT. Electricity facilities are adversely affected when the electricity supply is greater than the demand. Therefore in the case of solar power generation, the weather is relatively stable and power generation tends to increase, while air conditioner use is decreasing, output control is sometimes implemented in early autumn. Then the amount of electricity sold by the facility could drop, but dividend income is expected to be stable since the facility is operated on a fixed rent basis. It is important to note that the earnings impact will be affected by natural disasters and electricity sales prices in the future as the power plant continues to operate. If the profitability of the power plant declines or additional capital investment is required, there could have a negative impact on dividends.

With increasing awareness of ESG in the investment world, GPIF (Government Pension Investment Fund) also invests in infrastructure assets through its funds. The number of listed issues is still small, and liquidity is not high. Nevertheless, the current situation appears to be a unique tailwind for listed infrastructure funds, with its yield potential, its position in ESG investment, and the accelerating shift away from fossil fuels.

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/