The Tokyo Stock Exchange (TSE) and the Ministry of Economy, Trade and Industry (METI) announced on March 4 that they had jointly selected “the 2021 Health & Productivity Stock Selection”. Stocks which were selected under “the 2020 Health & Productivity Stock Selection” are outperforming the TOPIX. “Guidelines for Administrative Accounting of Investment in Health and Productivity Management” were formulated in June 2020, and “Health & Productivity” is likely to receive a more appropriate evaluation from the market. It has also been pointed out that the impact of “S” on the overall ESG assessment may be increasing as efforts to address “E” and “G” progress.

Visualization of “S” (Society)

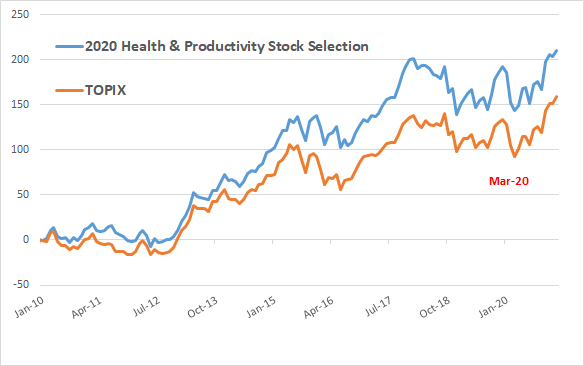

The index of companies selected as “Health & Productivity Stock Selection” has been outperforming the TOPIX. The following chart compares the long-term impact of the selection on stock prices and the impact after the announcement of the selection, using the “Health & Productivity Stock Selection” selected in March 2020.

Trends in stocks selected “the 2020 Health & Productivity Stock Selection” and the TOPIX

“Health & Productivity” is one of the indicators that will help “Visualize” the “S” of ESG investment, which is difficult to evaluate quantitatively. In its ESG Strategy Report dated March 10, Daiwa Securities pointed out that “Health & Productivity” refers to the strategic implementation of health management for employees and others from a management perspective, based on the idea that efforts to maintain and improve the health of employees and others are an investment that will increase corporate profitability in the future. The promotion of “Health & Productivity” is expected to revitalize the organization by increasing employee vitality and productivity, which will ultimately lead to improved business performance and corporate value.

Through this system, METI and TSE aim to promote corporate initiatives for “Health & Productivity” by selecting companies with excellent “Health & Productivity” and introducing them as attractive companies to investors who place importance on improving corporate value from a long-term perspective.

Administrative Accounting of Investment in Health and Productivity Management

“Health & Productivity” is likely to receive a more appropriate evaluation from the market in the future. In June 2020, METI formulated the “Guidelines for Administrative Accounting of Investment in Health and Productivity Management” for companies that are already implementing PDCA (Plan-Do-Check-Action) for “Health & Productivity.” It visualizes the costs and benefits of activities based on management accounting methods, using quantitative and monetary indicators as long as possible. From the perspective of collaborating with various stakeholders for the sustainable growth of the company, it is expected that the company will benefit from improved external evaluation by fully publicizing its “Health & Productivity” initiatives and gaining the understanding of a wide range of stakeholders.

According to the “Health & Productivity Survey 2021,” 3.6% of companies have created administrative accounting of investment in health and productivity management using the guidelines, and 20.5% plan to do so.

More specific disclosure for ESG assessment

As efforts to deal with “E” and “G” advance, the impact of “S” efforts on the overall ESG evaluation may be increasing. In its quantitative report dated March 15, Daiwa Securities conducted a survey on what parts of the integrated report lead to the ESG evaluation quantitatively by extracting text data that specifically mentions companies with high ESG evaluations, as the number of companies issuing “Integrated reports” that summarize non-financial information such as management strategies and social contributions is increasing every year and summarized it.

It pointed out that as of 2017, there were not many ESG-related words in itself, and that showing ESG initiatives even in a broad framework such as “Poverty,” “ESG,” and “SDGs” may have led to a certain ESG evaluation. On the other hand, in 2020, words such as “Anti-corruption,” “Diversity and inclusion,” and “CSR procurement” have started to appear. In recent years, there has been a demand for more specific disclosure, which may be linked to the ESG evaluation of companies, and they got the impression that there were many words related to ‘S’ in ESG. There is a possibility that “Health & Productivity” will gain more valuation in the market.

QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/