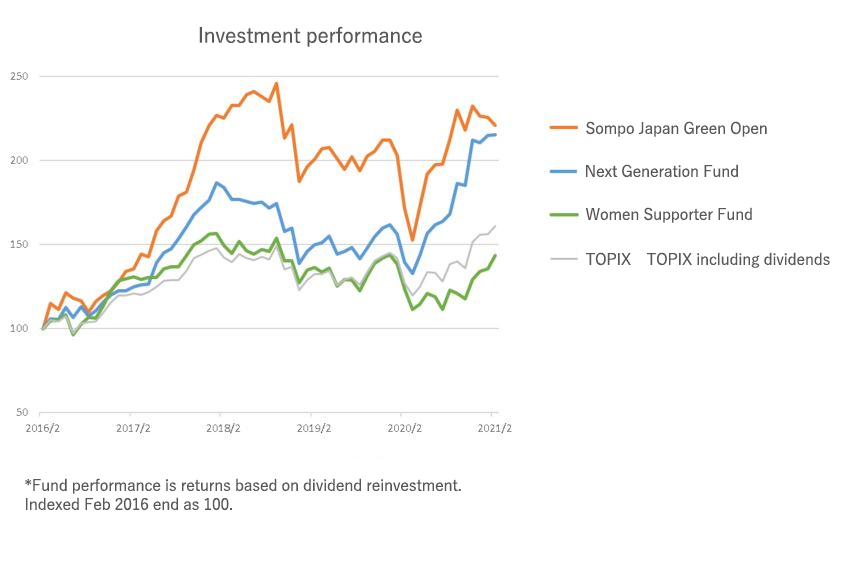

An increasing number of investment trusts are focusing on ESG (Environmental, Social, and Corporate Governance). Since there are differences among funds in the areas they focus on and their evaluation methods, many people do not know which one to choose even if they are interested in ESG investment. In this report, we examined major funds focusing on those that invest in domestic stocks.

Among publicly offered domestic open-end stock investment funds (excluding ETF, DC funds, limited open-end type, and currency selection-type), looking at the ESG-related Japanese equity funds classified independently by QUICK, as of the end of February, the fund having the largest total net assets (balance) was “Sompo Japan Green Open” of SOMPO Asset Management.

“Sompo Japan Green Open” is one of the pioneering eco-funds, which started its operation in September 1999 and invests in stocks of companies that are actively involved in addressing environmental issues. As of January 2021, the ultra large-cap stocks including NTT (9432), and Takeda Pharmaceutical Company Limited (4502) were composed of the fund. Returns (on a dividend reinvestment basis) over the past one, three, and five years have all been significantly lower than the Dividend-included TOPIX.

The second-largest fund in terms of balance is the “Women Supporter Fund” of Daiwa Asset Management, which invests in companies that are expected to grow through the active participation of women. About 80% of the stocks in the portfolio (as of the end of February) will be invested in small and mid-cap stocks. The five-year performance, at over 120%, was the largest of the 10 funds.

The 10th largest fund in terms of balance was the “Next Generation Fund” of Sumitomo Mitsui Trust Asset Management, which generally performed well in terms of investment performance. The fund has also been in operation for more than 20 years, since November 1999, and has leapt over the COVID-19 disaster with the performance of 54.4% over the past year. Constituent stocks are based on the following investment themes: “Information technology-related industries”, “Industries related to aging population and declining birthrate”, and “Industries related to environmental conservation and measures”.